According to a recent article, Wall Street Bonuses Flood NYC’s Economy, published by Adam Goldman, Wall Street does create more than nothing. Most people have the idea that Wall Street only creates money based on lying, cheating, stealing, greed and corruption. Although this may depict a handful of individuals on the street, I personally feel that the general public is jealous of their financial status. Therefore, they agree with the depiction of Gordon Gekko and his quotes in the movie Wall Street (by the way, I love the movie).

“The richest one percent of this country owns half our country’s wealth, five trillion dollars. One third of that comes from hard work, two thirds comes from inheritance, interest on interest accumulating to widows and idiot sons and what I do, stock and real estate speculation. It’s bullshit. You got ninety percent of the American public out there with little or no net worth. I create nothing, I own.” – Gordon Gekko, from the movie Wall Street

“Wall Street creates nothing. It innovates nothing. It simply cashes in if the gamble pays off and cashes out if it fails. Wall Street is loyal to nothing except the illusion of uninterrupted profits and constant economic growth in a finite world.”

–Washington Post

“Mr Temple is absolutely right in pointing out that Hedge Funds contribute nothing to the well being of the economy and most times act as destabilising agents in volatile markets.”

– Article written in England

I can agree with these comments in certain situations but I find it very interesting that detailed research shows how Wall Street creates jobs. And not more jobs on Wall Street! According to Mr. Goldman and Ken Bleiwas, three jobs are created in NY City and the suburbs for every one job created on Wall Street.

As they state in their article: “The impact of such bonuses on the New York economy is profound.

Bonuses are expected to generate $1.6 billion in tax revenues for New York state and another $500 million for New York City. For every job created on Wall Street, three other jobs are created in the city and suburbs.”

“When Wall Street does well, New York City and New York state do well,” Comptroller Alan Hevesi said. “Wall Street bonuses are spent in the city and in surrounding suburbs on entertainment, real estate, automobiles, and other consumer goods, all of which generates jobs and tax revenues.”

You be the judge. Does Wall Street create nothing?

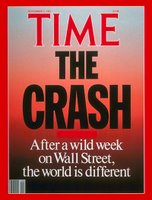

Theorists make money selling books that sell fear while investors and entrepreneurs make money by following their ideas with money and hedging against a possible crisis. I learn from history and history shows us that these “crisis” books will always sell during tough times. Readers eat up this garbage because most people are trapped in the rat race working their asses off just trying to stay afloat. Their attitudes are typically piss-poor and they love to read about huge negative events (especially a crash that may hurt others).

Theorists make money selling books that sell fear while investors and entrepreneurs make money by following their ideas with money and hedging against a possible crisis. I learn from history and history shows us that these “crisis” books will always sell during tough times. Readers eat up this garbage because most people are trapped in the rat race working their asses off just trying to stay afloat. Their attitudes are typically piss-poor and they love to read about huge negative events (especially a crash that may hurt others).

Connect with Me