I often get random questions from family members, friends, colleagues and social media followers that sound something like this: “I want to invest but I’m not sure what to buy, so can you recommend a few stocks.”

Or

I am saving for retirement (college fund, etc.), so where should I place my money (funds that they need to invest, commonly from an old 401k, a recent bonus, an inheritance, a stale IRA or whatever…).

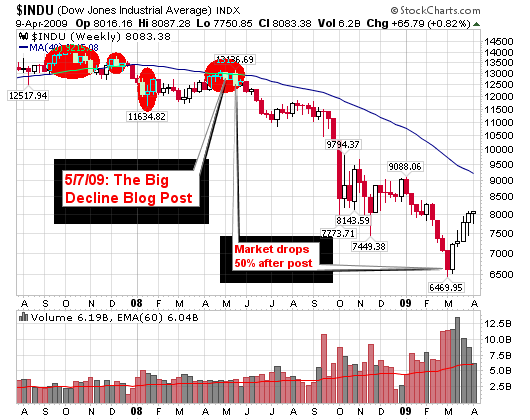

They tell me that they trust my advice because I seem to know what I am doing. Perhaps it’s because I have a blog, twitter account or a Stocktwits following but I immediately reply by saying: well, be careful because I am not independently wealthy (yet), based solely on my market investments so take my advice with a grain of salt. I then go on to say: But if you are asking…

Index Funds!

What? INDEX FUNDS!

Says the guy who writes about stock investing and trading…?

I strongly suggest that the majority of people stay away from actively managed mutual funds, active investment managers, day trading, swing trading, trend trading, any trading, etc. I am not opposed to individuals buying and holding a handful of dividend paying blue chip stocks but why bother with the headache; go for the index fund and save your time for doing something fun.

Place at least 90% of your available investment cash “the serious money” into index funds and then actively speculate with no more than 10% of the rest. This 10% can be used to buy your speculative investments like $FB, $AAPL, $GOOG, $AMZN, $TSLA, $V, etc…

William Bernstein (author of The Four Pillars of Investing) once wrote:

“It’s bad enough that you have to take market risk. Only a fool takes on the additional risk of doing yet more damage by failing to diversify properly with his or her nest egg. Avoid the problem – buy a well-run index fund and own the whole market”.

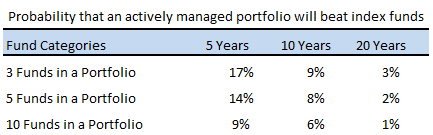

I agree: invest in one or more well-run index fund(s) that will promise a market return but with significantly lower fees. The average guy or gal in the 99% is not smart enough to “pick” the right stocks or mutual funds (or manager) at the right time. Heck, most fund managers in the 1% (Wall Street professionals) can’t do this either (data shows that greater than 80% of all fund managers fail to outperform the market over time).

Warren Buffett once noted that the moral of a story, as told in his 2005 Annual Report, is:

“For investors as a whole, returns decrease as motion increases.”

What does that mean? Well, let’s use a recent example of a bet Buffett made with a bunch of hedge fund managers back in 2007. The bet shows how an index fund mirroring the S&P 500 can outperform their actively managed funds, after fees, over a ten year period. They made a million dollar bet (winnings will be donated to charity) based on this premise and as of February 2016, eight years into the bet, Buffet is beating the all-star hedge fund managers 65% to 21%.

His Index Fund selection is crushing them and all he had to do was make a click or call to purchase the index fund and then he was done (not another minute was spent worrying about the investment). These managers (charging 2% on assets + 20% of performance) manage their funds daily and they are only 1/3rd of the return of Buffett’s choice (to date). So not only are they losing, they have spent eight years in their “professional job” losing to a fund that mimics the market.

Time = money so how do we even begin to quantify the hours spent by the hedge fund managers vs. the cumulative time that Buffett has saved doing other things. The extra time value is overwhelming so Buffett is much further ahead based on this ancillary bonus.

John Bogle (the founder of Vanguard) explains it this way in his book, The Little Book of Common Sense Investing:

“The way to wealth for those in the business is to persuade their clients, “Don’t just stand there. Do something”. But the way to wealth for their clients in the aggregate is to follow the opposite maxim: “Don’t do something. Just stand there.” For that is the only way to avoid playing the loser’s game of trying to beat the market.”

It means that the higher the level of investment activity, the greater the cost of investment fees and taxes, which ultimately results in a lesser net return for the investor.

I am an architect by degree so when I recall the famous quote by Ludwig Mies van der Rohe, “Less is More”, I suggest everyone apply it to investing as well.

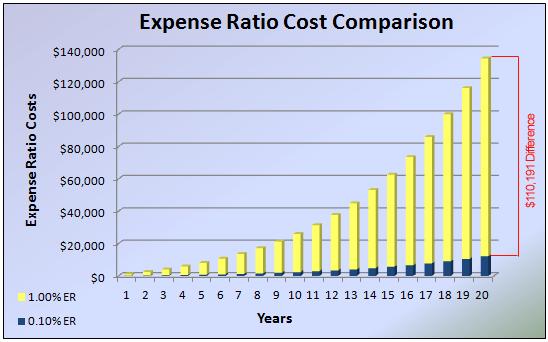

Less activity equals more return for the investor while more activity results in more profit for the fund managers leaving you, the retail client, with less retirement money in your pocket (see the charts and expense ratio matrix below).

Charlie Munger stated:

“The general systems of money management [today] require people to pretend to do something they can’t do and like something they don’t. That is a funny business because on a net basis, the whole investment management business together gives no value added to all buyers combined. That’s the way it has to work. Mutual funds charge two percent per year and then brokers switch people between funds, costing another 3-4 percentage points. The poor guy in the general public is getting a terrible product from the professionals. I think it’s disgusting. It’s much better to be part of a system that delivers value to the people who buy the product.”

So based on what Buffett, Bernstein, Bogle and Munger have said…

Where do you now think the 99% should invest their money? What should YOU be doing with your money?

[Read more…]

Connect with Me