I am going to start an occasional monthly post that highlights a stock that falls within the definition of a value stock but acts more like a growth stock. Berkshire Hathaway could be the ideal pick for the debut of this type of research but I am going to start with a company that structures itself in a similar fashion, Leucadia National Corporation (LUK).

I will also be looking into stocks such as BRK/A, SHLD, BAM and some of the recent banking stocks that may be undervalued (now and in the near future).

Value Stock of the Month

Leucadia National Corp. (LUK)

Wednesday’s Closing Price: LUK – $54.10

Sector: Financials

Industry: Multi-Sector Holdings

52-week Price: $30.01 – $54.10

Leucadia is a diversified holding company that has subsidiaries engaged in manufacturing, real estate, medical product development, gaming entertainment, mining, and energy. Does this remind you of Berkshire? Leucadia is known, by some, as a “mini Berkshire Hathaway” with an average annual return of over 22%.

By the way, BRK/A is currently trading along the 200-d m.a. for the first time since last summer ($110k per share). It closed today at $129,475 after reaching a 52-week high of $151,600 in December (a 14% slide). Chart at bottom of blog post.

Leucadia executives Ian Cumming and Joseph Steinberg each own about 13% of Leucadia’s shares and practice a methodology similar to that of Warren Buffett. A $10,000 investment 5 years ago in LUK is worth $43,029 today.

Leucadia has a strong record of stock market performance due to its strategy of finding assets and companies that are out of favor or troubled and are therefore selling at a discount to their inherent value.

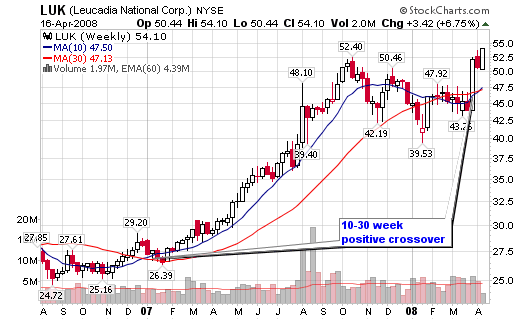

The stock just made a new 52-week high after using the 200-d m.a. as support while giving us a 10-week/30-week moving average crossover to the upside. My ideal accumulation area is near (slightly above or slightly below) the 200-day moving average (currently near $46). In hindsight, late 2006 and early 2007 was the “true’ ideal time to buy before the latest run. However, I should have listened to my old friend Kevin Pickell and grabbed shares years ago.

I was completely off on my timing of SHLD back in May 2007 so I may not be that bright when it comes to value companies but it’s time to start a new portfolio for my family that isn’t so young/fast time growth oriented (especially when people are running scared). SHLD will be my next value stock to research as it looks to be entering an area where accumulation is appealing.

Potential Trade Set-up:

Ideal Entry: $45 (low $40 range is better)

Risk is set at 3.0% of total portfolio or $3,000 of $100k

Stop Loss is 25% or $33.75

Number of Shares: 267

Position Size is $12,000

Risk is $11.25

Target is not material (value play)

*Notice the unusually large stop loss and risk versus trading a growth stock.*

Connect with Me