I’ll let the images do the talking today…

A blog about trading, finances, success and life itself

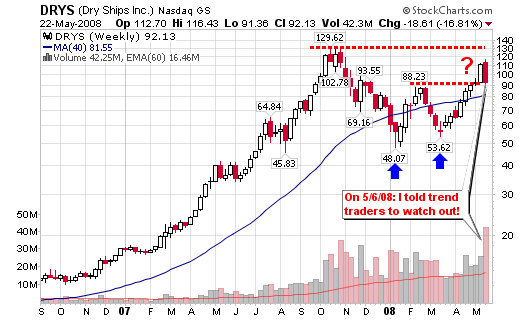

Well, DRYS is now down 16.81% this week and volume is peaking at the largest level we have seen in years – huge distribution!

This is what I had to say a few weeks ago in my post titled DryShips (DRYS) Drying up?

All in all – I am not a buyer of the stock at this level. It may be a solid short term buy for traders that make these types of plays such as Blain and Rajin but it does not fit into my criteria for a trend trading opportunity.

I see a decent consolidation over the past few months but I have a problem with the current pattern that is forming if it does not test former highs near $130. Volume is increasing as it moves higher but the stock is starting to struggle near the last peak of $88.

I stick to my original analysis as I am watching the stock from afar or the weekly chart. I am not day trading DRYS or any stocks for that matter so I can cut through the noise and view the market on a weekly basis to assess the “true overall trend”. Don’t get me wrong, many traders made money on the recent spike in DRYS but I wasn’t touching it with a 10-foot pole. I look for the big runs and couldn’t be bothered with a few points here and there (and I am not about to support my broker with constant buy and sell commissions, even if they are minimal).

The easiest way to characterize this trade and the market in general is to view it all as a risk/ reward potential or an expected value, as I wrote yesterday. DRYS was not a +EV trade in my trading system but, it very well may have been an excellent +EV trade for a shorter term day trader such as Rajin or Blain.

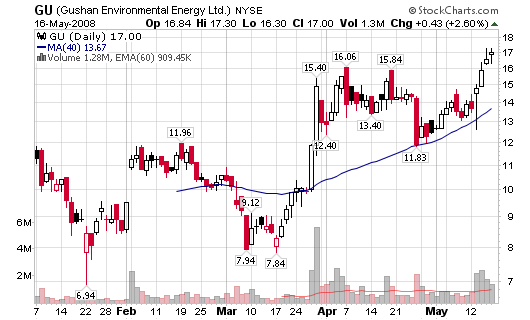

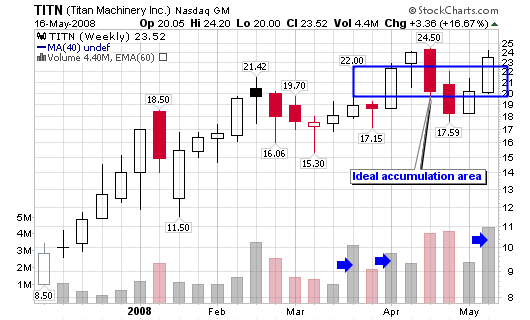

Anyway, here are a few more charts that are starting to look suspicious (some more than others). The bottom line or point of today’s rant is the fact that I still feel that the market is headed for a decline or as I phrased it a couple weeks ago:

The Big Decline (long term perspective of course).

These charts are just examples as many more exist but they were some of the first I viewed Thursday night:

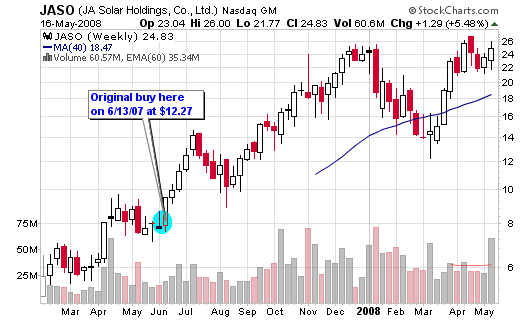

Today I cover four stocks that have been padding my portfolio over the past several weeks (months if we narrow it to EDU and JASO). Both EDU and JASO could be in my portfolio for many more months to come based on their fundamental and technical characteristics. This is in addition to the speculation lead-up to the Olympics in China.

JASO – 24.83, JA Solar Holdings is currently trading in the handle portion of a cup with handle base (one of the prime setups in the CANSLIM philosophy).

EDU – 80.08, New Oriental Education & Technology Group has come a long way since its correction down to the mid-$40 range. It closed above $80 on Friday and is now back within 15% of a new all-time high.

GU – 17.00, Gushan Environmental blasted 22.39% higher last week on above average volume as it closed at a new all time high.

TITN – 23.52, Titan Machinery is starting to flirt with all-time highs as volume is increasing during accumulation weeks

The pictures below are of me, my wife, my dog, my family and my friends. The photos range in age from 5 years ago to a few months ago.

|

|

Please see the post titled My Interview at StockTickr that leads to the full text link on StockTickr

Here is an example of the first few Questions and answers:

StockTickr: Tell us a little about yourself, Chris.

Chris: My name is Chris Perruna and I am 29 years old. I currently reside in New Jersey with my wife but was born and raised in NY (still my favorite place). I graduated college with a degree in Architectural Engineering and went to work for a historic preservation firm in Manhattan. I started as an intern with the firm while still in college and worked on several high end projects around the corner from Wall Street. It wasn’t until I was about to graduate that I knew I wanted to work on Wall Street and trade the markets professionally (rather than personally). I even signed up and took the trips to the exchanges each year through my university’s business school. I currently consult for a fortune 500 big builder as an architect (listed on the NYSE) and trend trade for capital appreciation. I am a trend trader looking for gains of 25% or more and losses no larger than 10% (preferably smaller). Understand that this 10% loss is calculated into a position sizing spreadsheet that only risks a maximum of 1% of total capital. My foundation is rooted in CANSLIM philosophies but I developed my system with detailed position sizing calculations and money management rules from Dr. Van Tharp.

StockTickr: What do you like to do outside of trading?

Chris: My hobbies include poker on a competitive level, a men’s flag football league in the fall and a softball league in the spring. It drives my wife nuts but I like to compete in most things I do so sports, poker and the market feed that craving. I also enjoy traveling, attending professional baseball and football games and dining at great restaurants. Del Frisco’s (NYC) gets the nod here!

StockTickr: How did you get started trading stocks?

Chris: I open my first brokerage account as a sophomore in college and have not stopped trading since. I first gained an interest in trading from my father who owned restaurants and traded heavily in the 1970’s and 1980’s. I still trend trade heavily based on his 200-day moving average plays. I started tracking stocks when I was a teenager but didn’t become “obsessed” until college. I started college when the 1990’s market was starting to really boom and I benefited greatly over the first couple of years – it was all luck, pure luck.

StockTickr: Most traders have a horror story about losing their shirt when they first started trading. What’s yours?

Click Here to view the entire Interview

Born and raised in New York but now living in New Jersey with a beautiful & loving wife, and two fantastic kids (boy and a girl). This site is about the stock market, success and life … [Read More...]

Copyright © 2025 on Genesis Framework · WordPress · Log in

Connect with Me