What if you could print the broken piece on your coffee maker rather than make a trip to the repair shop? What about skipping Black Friday madness by printing the latest toy for your child? How about printing that new pair of jeans you tried on at the mall but didn’t fit quite right (your body scanned for a perfect fit)?

Would you say that’s “crazy”?

Perhaps but that’s the direction the world is headed.

“Printing goes beyond product that you can see and touch”. Guitars, tables, board games — those objects can be printed today. But food, organs, bones, houses? Those “will take probably 10 years to come,” – says Geomagic’s Ping Fu

General Electric is “So Stoked About 3D Printing, They’re Using It To Make Parts For Jet Engines”

As Business Insider noted: “CONFIRMATION as to how seriously some companies are taking additive manufacturing, popularly known as 3D printing, came on November 20th when GE Aviation, part of the world’s biggest manufacturing group, bought a privately owned company called Morris Technologies.

Many manufacturers already use 3D printing to make prototypes of parts, because it is cheaper and more flexible than tooling up to produce just one or two items. But the technology is now good enough for it to be used to make production items too.

GE sees the purchase as an investment in an important new manufacturing technology. “Our ability to develop state of the art manufacturing processes for emerging materials and complex design geometry is critical to our future,”

Printing parts for jet engines is already here but the jeans, well, that may take some more time before its commonplace but it’s not out of the question.

So how can you invest to capitalize on this new industry?

Two stocks catch my eye in the world of 3D printing and rapid prototyping:

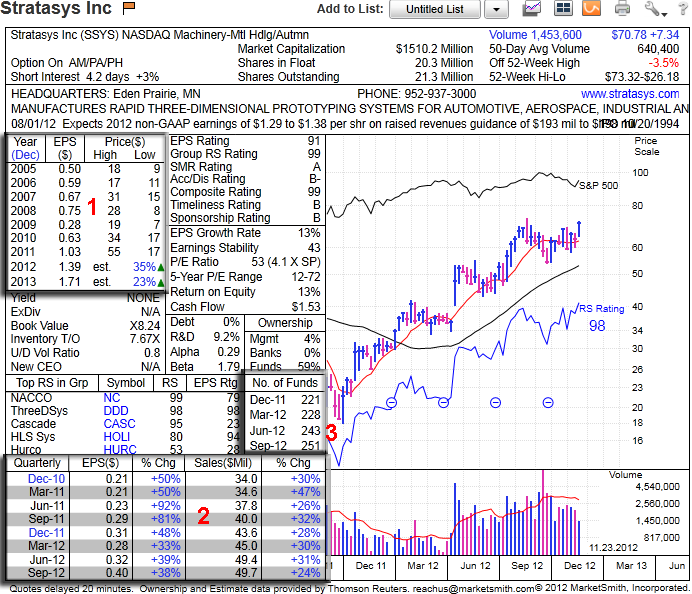

- Stratasys, Inc., SSYS

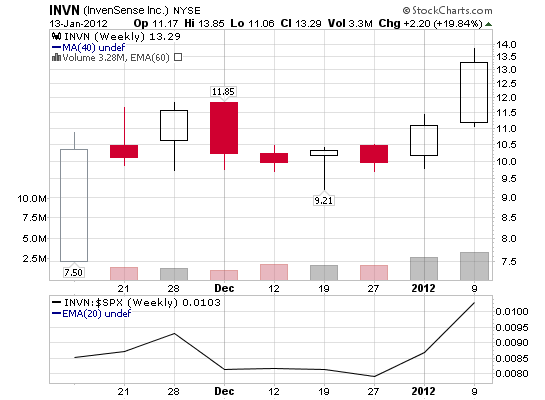

- 3D Systems Corporation, DDD

I don’t intend on spending this blog post describing the detail of the technology itself as plenty of that exists through a simple Google search, however, I will include basic company descriptions from Yahoo Finance (see bottom of post).

Several things stand out while researching these two stocks (see charts):

- Year-over-year EPS growth

- Double digit quarterly growth for sales and earnings (going back 8 quarters)

- Increasing Intuitional Sponsorship

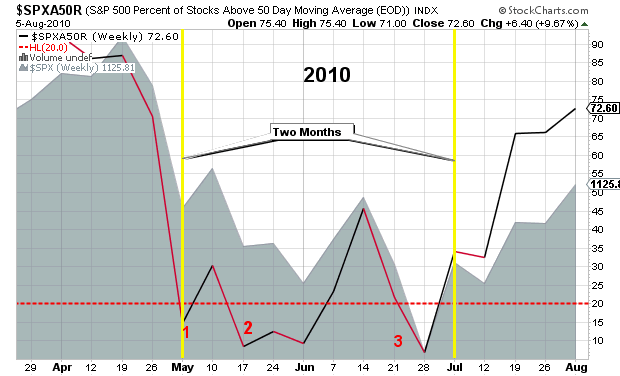

In addition to the fundamental items above, the daily and weekly charts for both SSYS and DDD show some solid technical setups for the long term (I am not writing this post from a short term perspective). We’re talking 2-5 years out as this game is only in its infancy with Wall Street.

SSYS has been trending higher for the past year showing a 170% gain since last November. The recent weekly pattern clearly shows a breakout point to new highs above $73.32. Considering the overall environment of the market, I would prefer a better risk-to-reward buying opportunity closer to the 50-day or 200-day moving average. Due to its technical strength, the 50-day moving average looks to be the ideal pullback area for accumulation.

DDD has pulled back more than SSYS and may provide investors with an opportunity sooner as it trades just above the 50-d moving average. Like SSYS, DDD has given early investors a great return on investment with a 193% gain over the past 12 months. I’d be suspect of the large distribution week, two weeks back, but as long as the 200-d moving average is not violated, an initial entry could be warranted.

As of this post, I do not own shares in either company but I plan to accumulate both as we head into 2013. Both the action of the individual stocks and the general market will dictate when I start the accumulation so please perform your own due-diligence. Follow me on twitter for my latest updates.

Lastly, as Stratasys notes on its home page, 3D printing is “ADVANCING INDUSTRIES” to which it highlights the following:

- Aerospace 3D Printing

- Automotive 3D Printing

- Commercial Products 3D Prototyping

- Consumer Products 3D Prototyping

- Educational 3D Printing

- Medical Device Prototyping

- Military 3D Printing

Yahoo Finance:

Stratasys, Inc., together with its subsidiaries, engages in the development, manufacture, marketing, and servicing of three-dimensional (3D) printers, rapid prototyping (RP) systems, and related consumable materials for office-based RP and direct digital manufacturing (DDM) markets. The company offers its products as integrated systems consisting of an RP machine and the software to convert the CAD designs into a machine compatible format, and modeling and support materials. Its products enable engineers and designers to create physical models, tooling, jigs, fixtures, prototypes, and end use parts out of production grade thermoplastic directly from a CAD workstation. The company also offers rapid prototyping and production part manufacturing services; and maintenance, leasing/renting, training, and contract engineering services for 3D production systems and 3D printers.

3D Systems Corporation, through its subsidiaries, engages in the design, development, manufacture, marketing, and servicing of 3D printers and related products, print materials, and services. The company’s principle print engines comprise stereolithography, selective laser sintering, multi-jet modeling, film transfer imaging, selective laser melting, and plastic jet printers. Its 3D printers convert data input from computer-aided design software or 3D scanning and sculpting devices to produce physical objects from engineered plastic, metal, and composite print materials. The company also blends, markets, sells, and distributes various consumables, engineered plastics, metal materials, and composites; and offers various software tools, as well as pre-sale and post-sale services, including applications development, installation, warranty, and maintenance. In addition, it provides custom parts services, such as precision plastic and metal parts service and assembly capabilities. The company markets its stereolithography materials under the Accura and RenShape; laser sintering materials under the DuraForm, CastForm, and LaserForm; and materials for professional printers under the VisiJet brands.

Connect with Me