I’m always in search of trends that may offer solid investment opportunities (using individual stocks) but at the same time may not be “bleeding edge” technology. The best performing trend trading stocks don’t have to be unknown or highly touted IPO’s but rather they can be established companies. In searching for trends in 2015, the list of stocks I have developed is a combination of small growth, IPOs and established names.

So let’s identify a few trends that should continue to grow in 2015 and then identify a few stocks within each of these groups that could provide some upside. One caveat: the overall health of the market must be positive in order for the majority of these investments to do well.

Six trends come to mind:

- Cyber Security

- Biotech

- Digital Wallets (currency) & Mobile Payments

- Drones & Unmanned Aircraft

- Self Driving Cars (Future of driving)

- Social & Web based brands

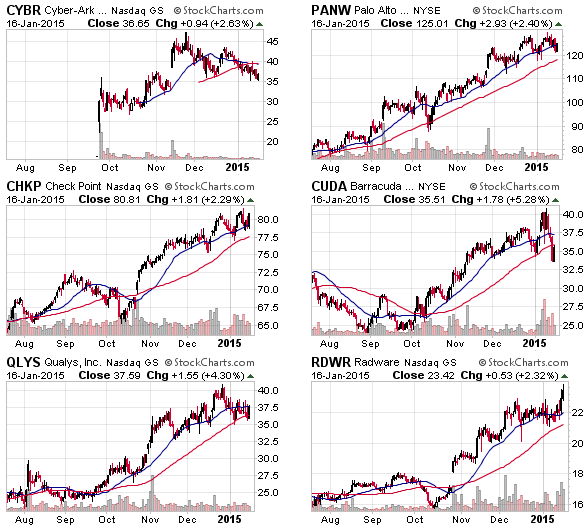

Cyber Security

$CYBR, $PANW, $CHKP, $CUDA, $QLYS, $RDWR

One of the obvious trends that should continue in 2015 is cyber security as breaches at major corporations around the world continue. Home Depot, Target, Staples, Michael’s and most recently Chick-Fil-A have all admitted to being “hacked”. And who can forget about the fiasco at Sony (whatever the real story may be). These companies and especially financial institutions must spend more money to protect their servers, clouds, data and integrity. This is precisely why I initiated a position in the cyber security sector in late 2014 and will continue to add to the position (at ideal risk / reward entries), using multiple stocks to diversify within this growing trend. One idea I have considered is building my own cyber security motif which would likely include several of the stocks listed above. Taking that idea further, a motif containing many of stocks listed in today’s overall blog post is a possibility as well.

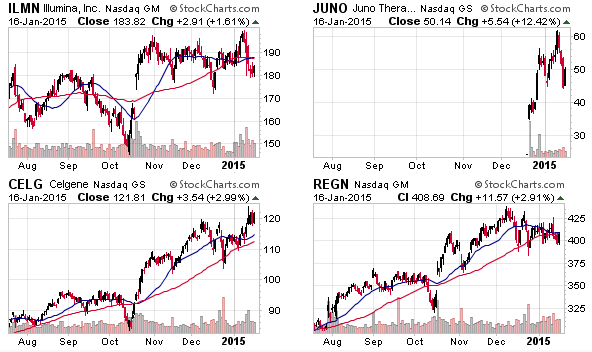

Biotech

$ILMN, $JUNO, $CELG, $REGN

The next trend that I like is biotech (a carry-over from 2014) and the big winner over the past several years has been Regeneron Pharmaceuticals. I have had the unique perspective of working with $REGN as they have expanded their headquarters in Tarrytown, NY; consulting for them (Real Estate & Construction) since January 2010 when the stock traded at $25 per share – it’s now trading above $400. Due to this professional relationship, I have mostly avoided talking about the stock on the blog and twitter.

With that said, I still like the broad sector. Illumina was a rock star in 2013 but traded mostly sideways in 2014. I liked the action in 2014 and view it as a long term flat-type base that looks poised to breakout above $200 per share. Sounds expensive, right? So did REGN at $100, $200 and $300 (after running from $25). $ILMN made a breakthrough in DNA sequencing and looks poised to continue that trend as well as expand elsewhere.

Next up is Juno Therapeutics, a biopharmaceutical company that engages in developing cell-based cancer immunotherapies. The company develops cell-based cancer immunotherapies based on its chimeric antigen receptor and T cell receptor technologies to genetically engineer T cells to recognize and kill cancer cells. Young IPO stocks are risky and typically like to build bases within the first year of trading but I am placing $JUNO on the list (use caution with first year IPOs). Cancer is not going away and the fight against it will continue to grow.

Both CELG and REGN can be added to a portfolio as their businesses continue to be cash cows.

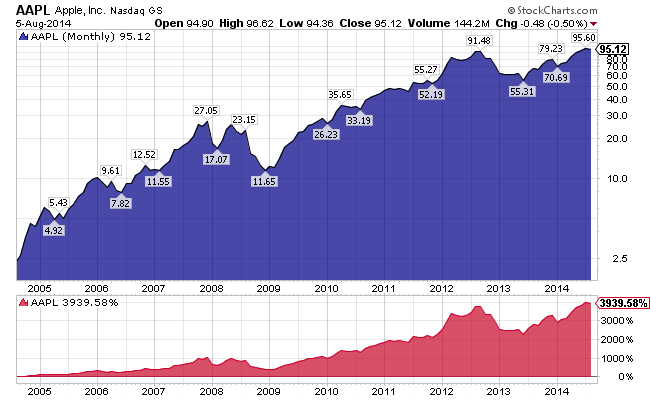

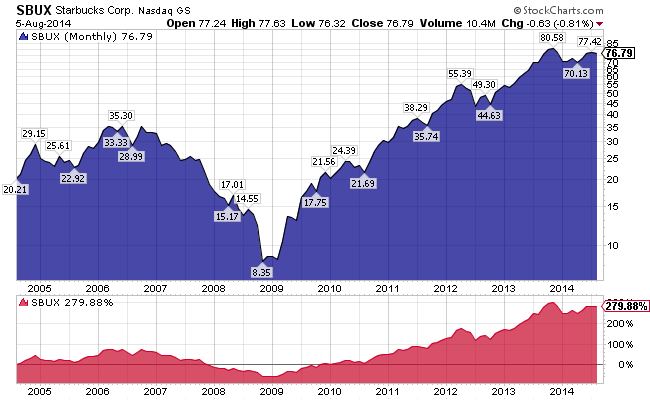

Digital Payments (currency) & Mobile Wallets

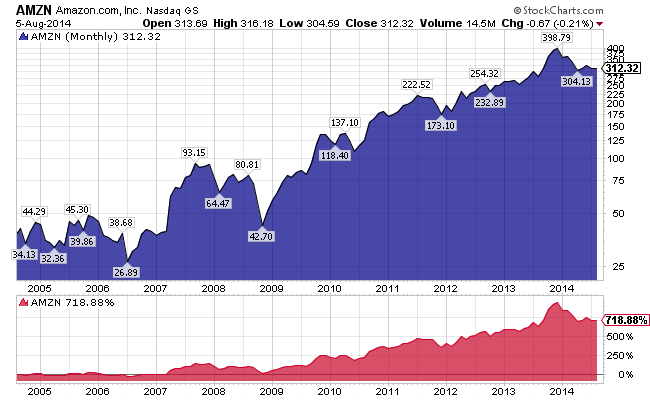

$AAPL, $GOOG, $AMZN, $V, $MA

Connect with Me