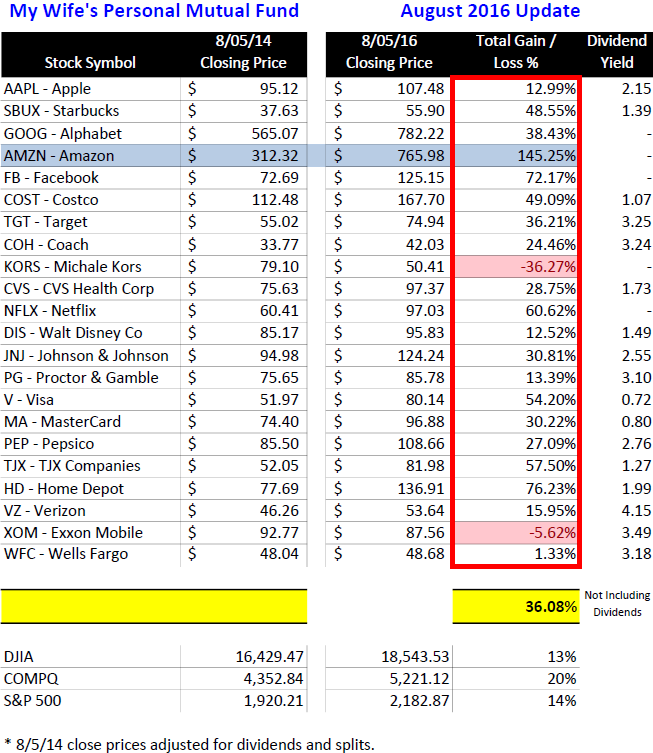

The Stock Trends for 2017, comprised of 21 handpicked stocks (discretionary style), is beating the major market indices by a healthy margin. The Nasdaq Composite is the closest but still trails by four percentage points. In order to be even, the Nasdaq would have to improve its year-to-date results (12.24%) by 30%.

The Dow Jones and S&P 500 would have to more than double their year-to-date gains in order to match the portfolio gains.

Year-to-Date Results:

- Stock Trends for 2017: +16.16%

- Nasdaq Composite: +12.34%

- S&P 500 Large Cap Index: +6.49%

- Dow Jones Industrial Average: +5.96%

Note: Dividends not included in calculations.

Fun Facts:

- 15 of the 21 stocks show a gain

- 13 of the 21 stocks show a double digit gain

- 6 of the top 8 gainers are triple digit stocks (5 started that way)

- The average gain of the positive stocks is +24.77%

- The average loss of the negative stocks is -5.36%

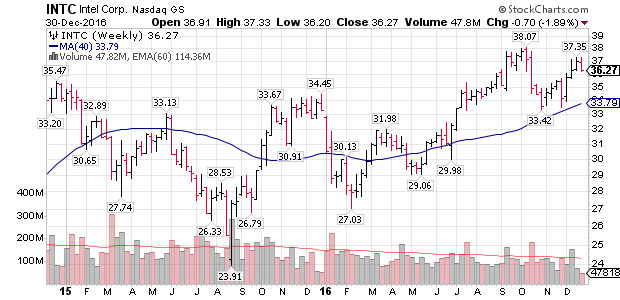

- MBLY is the leading stock, with a 62.43% gain, after being bought by INTC (another stock on the list)

I will continue to follow the logic of the opening paragraph from the original post:

The trends that I am watching in 2017 are not much different than what I have been following and investing in over the past two years. As Newton’s first law stated, “An object in motion continues in motion…”. I could search for the “next hot thing” each year but why make investing more difficult than it already is when certain trends, technologies, products, services and companies continuously work.

The plan is to keep riding all winning positions higher, until the market trend changes.

Connect with Me