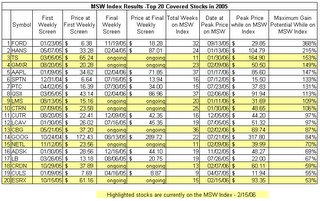

I have started to compile the complete results of the MSW Index and the MSW weekly screens throughout 2005 and have developed the top 20 list for your viewing on the blog. Click the picture at the bottom of this page to view the chart of the top 20 stocks from 2005. You will notice that 8 of the top 20 stocks are still active on the current MSW Index and several of the stocks with coverage initiated during 2005, ended their runs in recent weeks.

In the coming days, I will be uploading an exclusive page to MarketStockWatch.com that highlights the top stocks throughout the year, the worst stocks picks throughout the year, the ratio of winners to losers on the Index, our top shorting opportunities last spring and other important information about the stocks we covered in 2005. The next lists to appear on this blog will be the top shorts of 2005 and MSW’s biggest busts in 2005.

– As you all know, every trader has many busts throughout the year but the greatest traders learn to sell these stocks before they do further damage. As for the MSW Index; any stock that drops 10% from the initial coverage point is automatically cut!

Enjoy,

Chris Perruna “Piranha”

p.s. – Notice how many of the top stocks were covered week in and week out for 20 or 30 weeks (many consecutively) as they made their huge advances to profitability. (make sure the image opens to full size to read it properly)

Connect with Me