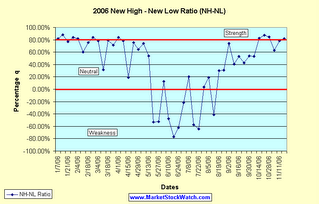

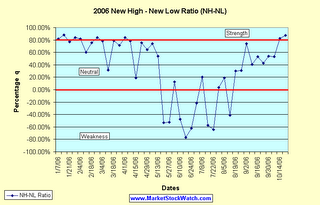

I wanted to take the time to update the latest New High – New Low (NH-NL) ratio chart which I follow from week to week on the MSW Index. Based on my research in 2005 and 2006, I have changed the level of bullish or positive signals to 60% from 80% with neutral now representing all readings between 0% and 60% and bearish or negative signals below 0%.

The chart in this post shows a graph that highlights the strength and weakness on the NH-NL ratio during 2006 and 2007. To calculate the percentage correctly, use this formula:

(New Highs – New Lows) / (New Highs + New Lows) * 100 = X%

For a further understanding of how I use the NH-NL ratio, read this post I made back on Tuesday, October 25th, 2005:

New High – New Low Ratio (NH-NL)

The weekly averages for the NH-NL Ratio (2007):

Saturday, January 6, 2007: 279-67, 61.27%

Saturday, January 13, 2007: 344-39, 79.63%

Saturday, January 20, 2007: 281-46, 71.87%

Saturday, January 27, 2007: 316-55, 70.35%

Saturday, February 3, 2007: 502-45, 83.55%

To View the numerical readings from 2006, visit this post:

New High – New Low Ratio

Connect with Me