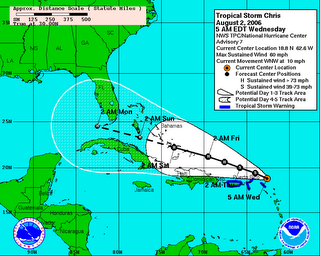

Crude oil topped $76 earlier today as Tropical storm CHRIS (what a name) gathers strength in the Caribbean and heads towards the Gulf of Mexico and possibly the Gulf Coast. Investors fear that the storm could grow into a hurricane and possibly disrupt oil output from the rigs in the Gulf area (similar to Katrina and Rita from last year).

Crude oil topped $76 earlier today as Tropical storm CHRIS (what a name) gathers strength in the Caribbean and heads towards the Gulf of Mexico and possibly the Gulf Coast. Investors fear that the storm could grow into a hurricane and possibly disrupt oil output from the rigs in the Gulf area (similar to Katrina and Rita from last year).

As an article by Simon Webb stated: “Last year’s hurricanes shut a quarter of U.S. crude and fuel output and sent oil to record highs. Around 12 percent of the U.S. Gulf of Mexico’s 1.5 million barrels per day (bpd) oil output is still offline.”

As you can see on the chart, crude oil has been trading in a range over the past couple of months with a support line near $70 and a shorter term support/resistance line near $75.

As you can see on the chart, crude oil has been trading in a range over the past couple of months with a support line near $70 and a shorter term support/resistance line near $75.

With the crisis in the Middle East and the threatening storm, oil related stocks and futures will be hot short term plays!

Piranha

Connect with Me