Most people reading this blog already know the differences between fundamental and technical analysis so I will not go into too much detail on each subject. However, new readers and novice investors may still be confused and that is completely understandable since many main stream analysts still focus on “the numbers” rather than the charts to determine their entry and exit decisions. Don’t get me wrong, I study the numbers and focus on investing in companies that actually turn a profit but the fundamentals don’t help me with my decisions of “when to buy” and “when to exit”. The foundation of my system is based on a CANSLIM philosophy that integrates fundamental and technical analysis. So please – take it easy value and buy-and-hold investors. We all know that there is no “ONE WAY” to invest successfully.

To start, turn on any major network news station and you will become bombarded by fundamental analysis and strong opinions based on fundamental numbers and nothing else. It’s the strong opinions that bother me more so than the actual dissection of the company’s balance sheet. Occasionally I will see a basic line chart posted on the screen that highlights the recent history of prices but it is presented without any study or analysis from the “talking head”. In addition to not focusing on charts, these analysts tend to concentrate on the same mega stocks each and every day (the most famous blue chip stocks or stocks of the past as I like to call them). It disturbs me that the “buy and hold” strategy is still the predominate scenario discussed on the major news networks and newspapers across the nation. Yes, buy-and-hold still works for some investors but it has cost many more large profits in the market because they believe their portfolio is doing well because it is always compared to the averages.

They tell you on Wall Street that you had a great year if your portfolio only lost 10% because the DOW and S&P 500 lost 20%. You beat the averages – they will tell you. What a bunch of crap because the entire purpose of investing is to make a profit and grow your net worth. I am not doing this to lose money and pat myself on the back that I only lost half as much as the averages. I’ll leave that thinking for the bozo’s of the world.

Reading corporate financial statements is an excellent skill for every investor but making short term buy and sell decisions based from this information can be costly. In my opinion (yes, my opinion), a short term trade is less than one month but I focus on intermediate trades which can typically be held from a few weeks to several months based on the action in the stock.

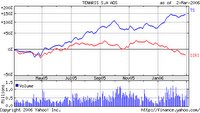

What most “average” bozos don’t realize is that a stock price usually breaks down well before the actual fundamentals turn negative and the official negative news hits the street. Reading about the Dow Theory could have given you this small piece of advice and that theory was written over 100 years ago. Insiders always start to sell when things are looking down or sales are not expanding. This poses a problem for the individual investor because they won’t know about poor sales or earnings until the official news is published or the company changes their outlook in a conference call, months after the problem has already developed. Look at the Home Building Industry for a perfect example. None of these companies reported losses until this year yet their stocks started to drop considerably, early last year. Toll Brothers (TOL) and KB Home (KBH) are used as examples in this post.

You may now ask: How can I sell before the fundamentals turn negative?

It’s called technical analysis, a study of chart patterns that allow the investor to determine if a company may be heading in the wrong direction or sideways pattern after an extended up-trend. Fundamentals make you aware of a particular stock to purchase as sales and earnings are rising quarter over quarter and year over year but they don’t get you out of the stock before the floor drops. Just because a company has excellent earnings or a perfect track record, doesn’t mean you buy immediately. You may be buying after an extended up-trend while the stock is due for a correction before its next up-trend. Nobody knows how long a correction will last; it can be 8 weeks, 8 months or 18 months. Why would you park your money in an investment that is stagnant or can possibly lose money for an extended period of time even though the bottom line is pretty? This is a common buy and hold strategy that the analysts tout to novice investors.

Technical analysis can help investors spot red flags such as distribution days, breaking of support lines or the violation of key moving averages. Pure Fundamental investors will not sell or even be aware of the current situation on the charts leaving them vulnerable to costly drops in price that may take years to recuperate. The talking heads of the media may still recommend a particular stock with a high risk chart formation only because they don’t understand that all key fundamentals are priced into the stock six months in advance. The technical investor will see the trouble arising and can take action well before the “bad news” hits the street. The technical investor won’t know what this bad news will be but they know it won’t be positive and that is the most important fact.

When technical red flags are flashing in all directions; sell and wait to see how the stock is going to react and what news is on the horizon. Sooner, rather than later, negative news will come out from the company stating that sales have slowed, a contract was lost, a drug was not approved, or maybe the CEO is resigning. Whatever the negative news may be, as soon as it hits the headlines, fundamental analysts will be talking their heads off at how it may be time to sell (even though the stock is now many percentage points below the key sell signals flashed on the charts). The stock has usually dropped dramatically by this point but the numbers have not been updated until now, the time the whole free world can now sell for a significant loss. On the other hand, the buy and hold investor will usually just hold and claim that they broke even or made a profit several years in the future. Who cares if you make 25% or 50% over a 5 or 10 year period. Don’t allow a loss of 10% snowball into a 50% drop in your portfolio. Stocks such as Microsoft may take another 5 years or more just to break some investors even from 2000. That would make 10 years or more for the poor sole that bought in the bubble burst of 2000.

I use both fundamental and technical analysis to make decisions in the market and believe that both tools give you an advantage over the investor that only uses one of these tools. It’s just a matter of how, when and where each of these tools are used that can add to your overall success.

Connect with Me