Need I say more?

A Picture is Worth a Thousand Words

Crude Breaking above Resistance

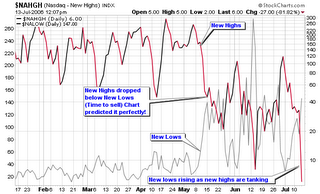

The NASDAQ is getting slammed below the recent up-trending support line as it trades below the June low (intraday action). If the NASDAQ closes below the June low, the attempted rally would be completely erased. Looking at the NH-NL ratio for the NASDAQ, we can see how new lows are rocketing higher as new highs are plummeting to almost nothing today. New lows use the number scale to the left of the chart while new highs use the number scale to the right of the chart.

The NASDAQ is getting slammed below the recent up-trending support line as it trades below the June low (intraday action). If the NASDAQ closes below the June low, the attempted rally would be completely erased. Looking at the NH-NL ratio for the NASDAQ, we can see how new lows are rocketing higher as new highs are plummeting to almost nothing today. New lows use the number scale to the left of the chart while new highs use the number scale to the right of the chart.

Crude oil is also up over 2.5% as it broke above the resistance level of $75 a barrel. The daily chart highlights the break above the trading zone between $70 and $75. I told you to cover all “long” losing positions last night or positions that were turning against you with a slight gain. I will be very interested to see how the afternoon finishes and will update the day’s action on the daily screen tonight with all interactive charts telling the story in real time.

Piranha

Can the NASDAQ – Crude Oil Index predict Bulls & Bears

As many of you know, I have had a lot of time on my hands as the market has been trading in volatile patterns with a downward bias. The majority of my money has been parked on the sideline since mid-May with the exception of a few open option contracts (longer term plays). I have not made a trade in five weeks since the start of my vacation in late May and I have become very bored. It’s been tough writing nightly market analysis but I am doing my best to locate possible short setups, consistently monitor the mechanical screen and follow the few market leaders (I prefer to call them stocks with the best RS ratings and charts as no true leaders exist right now).

As many of you know, I have had a lot of time on my hands as the market has been trading in volatile patterns with a downward bias. The majority of my money has been parked on the sideline since mid-May with the exception of a few open option contracts (longer term plays). I have not made a trade in five weeks since the start of my vacation in late May and I have become very bored. It’s been tough writing nightly market analysis but I am doing my best to locate possible short setups, consistently monitor the mechanical screen and follow the few market leaders (I prefer to call them stocks with the best RS ratings and charts as no true leaders exist right now).

Using this free time, I have been comparing certain market indexes with other benchmarks that I have been following over the past 6-12 months. Two of these include the NASDAQ and crude oil (light contracts). Two charts are loaded to this blog post:

- The first chart is a combination index that I created myself using Stockcharts.com advanced tools. It combines the average close of both the NASDAQ and crude oil contracts over the past 10 years with a 200-d moving average. As you can see, the progression of this chart has called every major up-trend and downtrend before it was about to happen. The gray line on the chart represents the actual close of the NASDAQ index over the past 10 years (this line varies from the combo index). The only major divergence between the combo index I created and the actual price of the NASDAQ is during the past 18 months (since crude has gone wild). The combo index continues to trade downward as the NASDAQ trades sideways to slightly upward.

- The second chart compares the action among the NASDAQ and crude oil over the past 10 years without any special combination effect. As you can see here, both entities have been trending higher over the past 18 months. This is very different from the combo index in the first chart.

So how would I use this combo index?

It is a long term outlook index that seems qualified and prepared to call the next major up-trend for the NASDAQ. To do this, the combo line must cross back above the 200-d moving average with strength and consistency. It has not stayed above the 200-d m.a. for long periods of time since 2003, the most recent “up-trending bullish market”. Prior to 2003, we have not seen a true bull market up-trend with this combo index above the 200-d m.a. since 1997-1999. From mid 2000 on, the combo index has spent much of its time below the 200-d m.a. and we all know how the market has behaved since March 2000.

So, to answer a question I received about a recent comment on a blog post: yes, I do believe that crude oil must cool off before we can sustain a major bull rally and this combo index may prove my theory correct if it continues to trade accordingly. But then again, it is only a theory and I am not into predictions.

Enjoy the combo index.

Crude Oil Testing Highs & Resistance

I posted a blog entry last month about SWN and the possibility of a short based upon the overall trend of crude oil. That post can be found here: Southwestern Energy Short?

I posted a blog entry last month about SWN and the possibility of a short based upon the overall trend of crude oil. That post can be found here: Southwestern Energy Short?

If you scroll down to the bottom of that entry, you will find a chart I uploaded of crude oil showing where the resistance plays a major role. If crude fails to make a new high without surpassing the resistance, I will start to look at several short term shorting opportunities within the sector (SWN being one of them). If SWN reverses and closes below the moving averages, the short will be on (in my case, I am buying put options to follow my idea).

This link takes you to an article that talks about the possible push to new highs for crude oil: Oil retreats to $68 after falling short of record

Piranha

Connect with Me