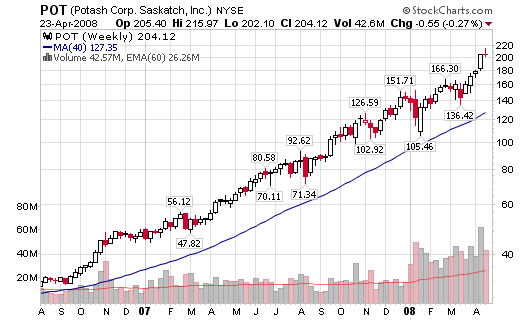

Can Intrepid Potash (IPI) follow in the footsteps of Potash Corp. Saskatch, Inc. (POT)?

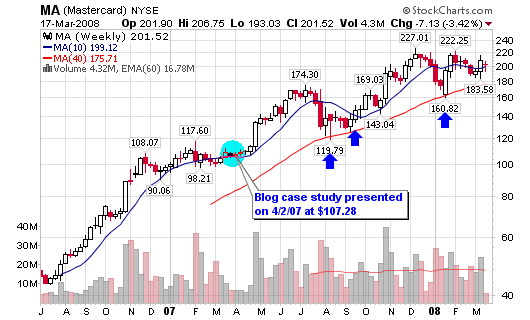

If you don’t know by now, POT is up 552% over the past two years, 230% over the past 12 months and 43% year to date; all while the S&P 500 is down 2.25% year-to-date, an amazing accomplishment in this market environment (see chart below).

Intrepid Potash Inc, a producer of crop nutrients, raised $960 million with an initial public offering that priced shares above expectations in the $27 to $29 range. The IPO price came in at $32, $3 above the top of the range expected by underwriters. The original estimate was for 24 million shares to be priced between $24 and $26 per share (30 million shares were offered at $32).

Intrepid Mining, the parent company of Intrepid Potash claims to be the largest potash producer in the U.S. I missed the HUGE up-trend in POT but IPI may give this industry one last run before the trend is over. Markets are not efficient so the greed of crowds may take this IPO higher due to the recent performance of POT. Risks will be associated as a quick sell-off could be a huge possibility if things don’t go the way investors expect.

As you can see from the charts, IPI priced at $32 per share but jumped as much as 50% during the trading debut. The stock reached a high of $53.50 today but closed down 2.6% at $49.09.

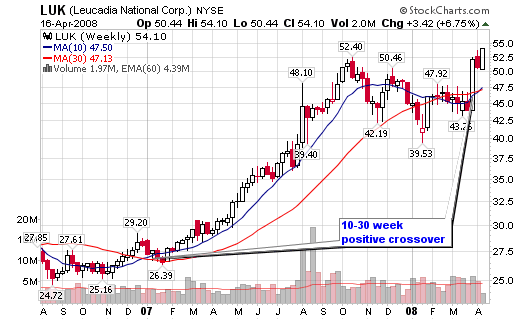

Tate from Self Investors notes:

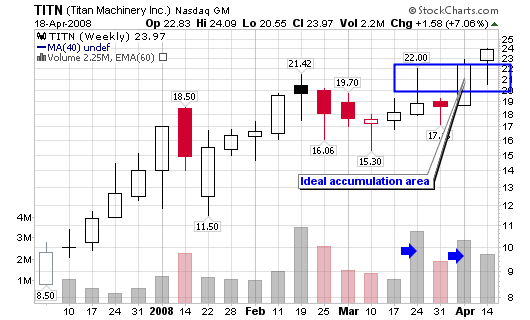

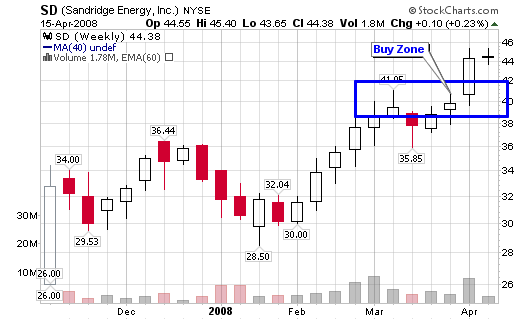

“As far as the fundamentals, they look solid but nothing extraordinary. My take on this is that this IPO comes at a time when the agriculture stocks appear to be near a major top with perhaps one more last climax run left in them. Does this IPO signal the top? Just maybe. Like all IPO’s I’ll let it trade for at least two weeks and only enter on a breakout from a bullish pattern.”

I tend to agree with his analysis for the most part. I will not hesitate to jump on a trend if IPI starts to run higher because crowds are persistent and I don’t like to fight them.

Connect with Me