I’ve decided to mix it up this year, rather than repeat the similar trends list from the past several years. Don’t get me wrong, the Stock Trends lists from the past several years have performed amazingly well, I still own shares in several of those names and I continue to recommend many of them going forward.

But I have been watching a new crop of lesser known growth names. These stocks may carry with them more risk as their brands, revenue and social status aren’t at the level of the Stock Trends stocks (i.e.: AAPL, AMZN, V, MA) but the growth potential is what excites me.

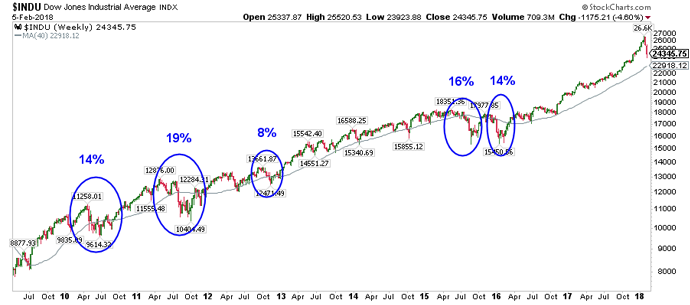

I suggest caution if buying shares in early 2019, considering the major indices are trading below their 200-day moving averages. Further, the New High – New Low readings are negative right now so until they can regain positive status, further downside risk is possible.

There are several criteria that I am using to identify the list below: increasing sales, increasing earnings, strong relative strength and IPO’s within the past several years. I’m specifically searching for the next crop of young growth companies that can provide above average gains over the next 12-24 months. I am aware that a few of the stocks listed are lacking in the “relative strength” department.

-

OKTA – $63.80: Okta, Inc. provides identity solutions for enterprises and other businesses, serving in the security software sector, along with companies such as PANW and CYBR.

Sales have been increasing QoQ by an average of 62% the past 8 quarters, from $48.8MM to $105.6MM (Jan 2017 – October 2018 periods). The stock is still young, with an IPO on April 7, 2017 yet institutional fund sponsorship has increased more than 55% over that same Jan ’17 to Oct ’18 period.

Technically, the stock made an all-time high back in September, reaching $75.49, before selling off along with the rest of the market, above its 50d and 200d moving averages. The relative strength rating is currently 98, showing that the shares are holding up better than most of the market. An ideal area to grab shares in anywhere in the $50 range, above the moving averages. I see OKTA as a classic $60 to $100 mover over the next 12 to 24 months.

-

TWTR – $28.74: Twitter, Inc. operates as a platform for public self-expression and conversation in real time. The company offers various products and services, including Twitter that allows users to consume, create, distribute, and discover content.

Sales have been increasing the past three quarters (YoY) by an average of 24.6%, from $664MM to $758MM. The stock debuted on the market on November 7, 2013 and I was a big fan of the stock back then but was far too early as they hadn’t figured out how to make money yet. The company has since figured that out as earnings have increased an average of 117% over the past three quarters while institutional sponsorship has increased 59% over the past 4 quarters.

Technically, the stock made a 52-week high back in June, reaching $47.79, after spending nearly two years in the teens and $20’s. The relative strength rating is currently 77, which isn’t excellent but not terrible. Historically, TWTR has been volatile with some big swings up and down so I don’t recommend the stock for those with a weak stomach for the unexpected. Shares are currently trading below the 50d and 200d moving averages but holding support in the $26 range. Long term, I see this as a $50+ stock so one may start to initiate a position below $30 and be prepared to hold through some volatile times.

-

CGC – $26.87: Canopy Growth Corporation, together with its subsidiaries, engages in growing, possession, and sale of medical cannabis in Canada. Its products include dried flowers, oils and concentrates, softgel capsules, and hemps.

Sales have increased from $9.8MM in December 2016 to $23.3MM in September 2018, an increase of 137% over 8 quarters. However, earnings are still negative but are poised to become positive in FY 2020. Institutional sponsorship has increased by 157% but the number of holders is still relatively small when compared to most established stocks; to be fair, the stock only debuted on the American market in May 2018 so it will take time before the institutions can accumulate larger positions (I see this as a positive).

Technically, the stock has been sliding, losing 50% of its value over the past two months, from its all-time high of $59.25. It currently trades below both its 50d and 200d moving averages, not a positive sign. I do believe that CGC will remain one of the faster growing suppliers as states within the US continue to legalize marijuana products. Ideally, I’d like to see a base form over several weeks which would signal a bottom before recommending shares to be purchased. Long term, 12-24+ months, I see this stock having the potential to trade back above the $50 mark.

-

TEAM – $88.98: Atlassian Corporation Plc, through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide. It provides project tracking, content creation and sharing, and service management products.

Software is hot heading into 2019, and subscription-based companies have been tearing it up for years (i.e: NFLX, ADBE, ADSK, AMZN, etc.). The recurring revenue model is genius vs selling a software package out of a box every few years.

Technically, the stock made an all-time high coming into October at $98.21 but has since corrected, falling as low as $65 in November before recovering back to the upper $80s (approximately 10% off highs). The relative strength rating is a solid 98 and the stock trades above both the 50d and 200d moving averages, something not many stocks can claim these days. My ideal entry is closer to the 50d ma, which currently sits between $77-$78 per share.

Fundamentals are strong as well, with quarterly earnings averaging 37.5% increases YoY over the past 6 quarters and sales averaging 40% increases YoY during that same period. Sales have gone from $148.9M in the December 2016 quarter to $267.3MM in the latest September quarter. Annual earnings are projected to go from $0.52 in FY 2018 to $0.78 in FY 2019 and $0.97 in FY 2020.

-

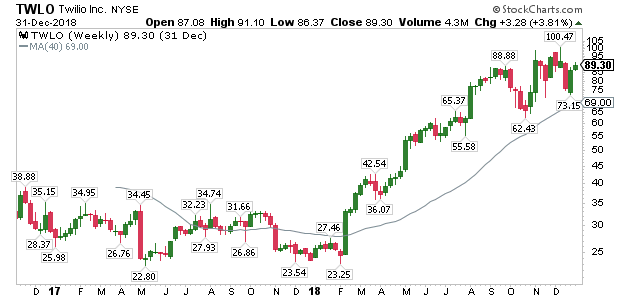

TWLO – $89.30: Twilio Inc. provides a cloud communications platform that enables developers to build, scale, and operate communications within software applications in the United States and internationally. The company’s programmable communications cloud provides a set of application programming interfaces that enable developers to embed voice, messaging, and video capabilities into their applications.

With a 99 relative strength rating, TWLO is one of the top performing stocks over the past few months, trading above both its 50d and 200d moving averages. Sales have averaged a 47.9% quarterly growth rate (YoY) over the past seven quarters, with the largest growth period last quarter, at 68%. Sales have grown from $87.4MM in March 2017 to $168.9MM in September 2018. Earnings turned positive in the June 2018 quarter, $0.03, and followed that up with a $0.07 quarter in September 2018 (the previous five quarters were all negative). Institutional holders have increased 146% over the past eight quarters.

The stock made an all-time high of $100.47 in December but pulled back more than 25% to $73.15 before settling about 11% off highs, just shy of $90. The ideal accumulation zone is either along the 50d ma (currently $82 range) or just above the 200d ma (currently $66 range). I’m not sure if the stock will retreat back to the 200d ma so accumulating shares in the $80s is fine for now.

-

SEND – $43.17: SendGrid, Inc. operates as a digital communication platform in the United States and internationally. Its cloud-based platform provides various tools to the businesses, including developers and marketers to reach their customers using an email.

SendGrid has a 98 relative strength rating for a stock that debuted in November 2017 with a 100%+ move since IPO. The risk with SEND is the fact that it has not had that first correction phase since the IPO, something I prefer to see in a young stock, before a long term sustained run.

That aside, sales have averaged a 36.5% quarterly growth rate (YoY) over the past seven quarters while actual figures have grown from $24.8MM in March 2017 to $37.2MM in September 2018. Earnings have grown 100%, 400%, 100%, 400% and 150% the past five quarters (YoY), going from $0.01 to $0.05. Projected earnings for the stock are expected to be $0.16 in FY 2018 and $0.21 in FY 2019 (from $0.08 in FY 2017). Institutional holders have increased 135% over the past four quarters. SEND is in the same industry as TEAM.

Similar to TWLO, SEND is trading about 11% off of its all-time high, which was set back in December at $48.41. The ideal buy is near either of the major moving averages, which are at $39.88 and $32.21 respectively.

-

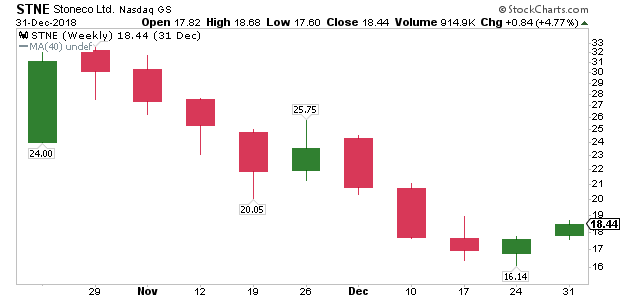

STNE – $18.44: StoneCo Ltd. provides financial technology solutions that empower merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

I’ve been a big fan and holder of financial solutions and credit companies for years (i.e.: Visa, Mastercard, Square) so naturally, STNE grabs my attention. Sales have increased an average of 91% per quarter (QoQ) over the past seven quarters (moving from $52.4MM to $103.7MM), while earnings are up 200%, 600% and 700% the past three quarters respectively.

The stock is new to the market, IPO date of 10/25/18, which carries with it some risk as there’s no history of action. The stock is down 45% from its 52-week high which took place IPO week but the fall has happened as the market folded. I am basing this selection off of its future potential where yearly earnings are projected to go from $0.05 in FY 2017 to $0.32 in FY 2018 and $0.80 in FY 2019.

-

NIO – $6.37: NIO Inc. designs, manufactures, and sells electric vehicles in the People’s Republic of China, the United States, Germany, and the United Kingdom. NIO is a competitor of TSLA, a stock that I have highlighted on Stock Trend lists for years. I went with NIO this year because I have grown somewhat suspect of the financials over at Tesla. Perhaps there’s nothing there but my gut seems to think otherwise, we’ll see (I do not own shares in TSLA as of this writing). With that said, it’s tough to show confidence in Chinese based companies as their financials are often suspect as well.

As of now, I own call options in NIO which expire in February 2019 but I do not own straight shares. Why, because I don’t have enough technical and fundamental data to base my decisions on, other than pure speculation that NIO will be a player in the exploding global electric vehicle market. Consider that the Chinese population is 4.3x the size of the US, that’s what gets me interested in this company.

Per Forbes, Chinese demand for EVs is expected to eclipse 1 million units in 2018, about half the world’s total. That number will go to 5 million by 2025, propelled by government quotas and incentives. The ES8 starts at $67,000 which is about half the cost of an imported Tesla Model X (after tariffs). So where do we buy? Here, based on pure speculation over the next several years. If the company has substance, I can see shares pushing towards $20 in the distant future or 3x from the 2018 close.

-

IMMU – $14.27: Immunomedics, Inc. is a bio-pharma company that focuses on the development of products to treat cancer, autoimmune disorders and other diseases. The company has been focusing on commercializing sacituzumab govitecan as a third-line therapy for patients with metastatic triple-negative breast cancer with an FDA decision due by January 19th.

The play is a risk, pending FDA approval. The stock made a 52-week high back in July at $27.33 but has been beaten down recently due to some faulty information that was submitted to the FDA. I do have concerns based on this news and a recent class-action lawsuit filed due to the untimely non-disclosure of this information. I am currently a shareholder, dating back to December 2017 and plan to hold through the FDA decision. Provided the company gets approval, I plan to hold long term unless circumstances change. Without approval, the stock is likely done (I will sell immediately). With approval, I expect their drug to bring in strong sales thus boosting earnings QoQ and YoY for quite some time.

Institutional sponsorship has increased 44% over the past four quarters and 155% over the past eight quarters, which makes sense as the stock moved from a low of $2.02 to a high above $27 (1,200%+ move). Using pure technicals, there is not a signal to buy shares now, rather it’s all based on FDA speculation.

-

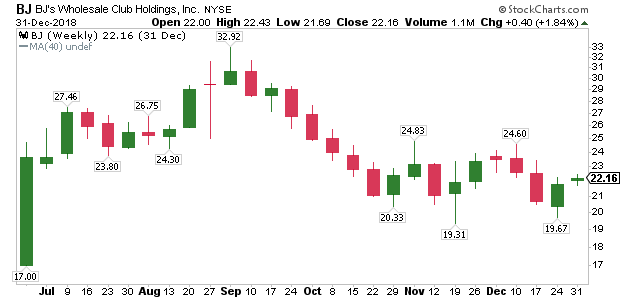

BJ – $22.16: BJ’s Wholesale Club Holdings, Inc. operates as a warehouse club on the East Coast of the United States. It offers perishable, edible grocery, general merchandise, and non-edible grocery products. I am familiar with BJs and Costco living in NY and NJ as they are similar stores but I am only a member of COST (I do think it’s better).

The stock IPO’d on June 28, 2018, hoping to follow in the footsteps of Costco which has been a great stock over the past 10 years. I can see BJ’s shares doubling, from current levels, over the long term but they need to increase sale’s growth and locations. Costco, a much larger company, has been growing sales more quickly, by an average of 11% QoQ over the past 6 quarters while BJ’s has only been growing sales by 4.3% over that same period. On the flip side, Costco earnings have grown by an average of 18% while BJ’s has grown by 145% over that same period. As of last quarter, 2,137 intuitional holders had positions in COST while only 249 holders had shares in BJs. BJs has room to grow if they can execute properly.

Honorable Mentions:

- ALRM – $51.87: same industry as TEAM and SEND

- COUP – $62.86: same industry as TWLO

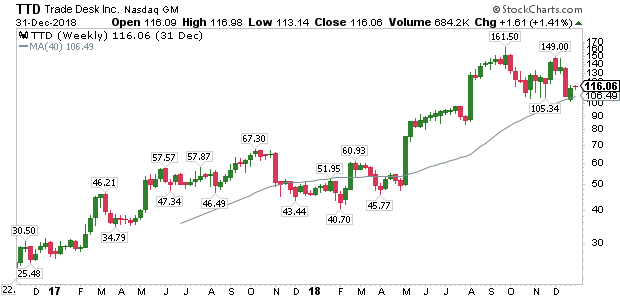

- TTD – $116.06

- PAYC – $122.45: same industry as TWLO

Previous Stocks Trends Lists:

January 1, 2018: Stock Trends for 2018

My Wife’s Mutual Fund:

Original Post:

August 6, 2014: My Wife’s Personal Mutual Fund Outperforms the ProsFollow-ups:

February 21, 2016: My Wife’s Personal Mutual Fund Crushes the Markets, AGAINAugust 7, 2016: My Wife’s Buy & Hold Strategy Still Crushing the Professionals

November 19, 2017: The Wife’s Stocks Outperforming 3 Years Later

Connect with Me