Learning about Stocks (Fundamental and Technical Principles):

System Development and Market Psychology:

Great All-around Reads:

Others:

A blog about trading, finances, success and life itself

Learning about Stocks (Fundamental and Technical Principles):

System Development and Market Psychology:

Great All-around Reads:

Others:

chrisperruna twitter stock selections 2009:

Visa (V) turned out to be the stock I tweeted about the most starting on March 31, 2009 (my first day of twitter) at $55.60. I mentioned that “the pivot point is $61.50…then look for $60-$100 move” on April 26 2009. Well, the stock closed the year just shy of $90 and is well on it’s way to a $60-$100 run for a near 60% gain. Disclosure: I personally owned more shares of Visa in 2009 than any other stock listed below (my position is currently 100% closed).

The top gaining stock of the year was MELI, featured on May 12, 2009 at $25.60; it closed the year at $51.87 for a 103% gain.

Here is a re-cap of all the stocks that I featured on twitter in 2009:

Total Stock Selections : 63

Total Winners : 50

Win % : 79%

Total Losers : 13

Loss % : 21%

Total Average Gain : 24%

Average Gains (winners) : 36%

Average Loss (losers) : (15%)

**Keep in mind, these stats are based on pure buy and hold (no trading rules calculated in)**

A full spreadsheet of my picks can be found below.

I figured I would recap my last 100 tweets to those of you that still check into this blog but don’t follow me on twitter. Please, check me out on twitter as I do most of my writing and thoughts over there as the new family life prevents me from writing intense, heavily researched stock blog posts. I am not in the business of writing short crappy blog posts so I focus my time on actionable ideas and education on twitter. I plan to one day return to more consistent writing on the blog. Until that day, follow my tweets to stay in touch with my thoughts on the market (1,200 other people already follow).

If you can take anything away from my recent tweets, focus on the message of the following ten tweets, reference the bold type (they all show caution and skepticism in the market based on the lack of individual leaders). New Highs have been reaching levels not seen in years but they are still far below the levels necessary for a “true bull market”, one that will be sustainable.

1. $V – hit new highs day after day on volume less than half the ave. Gets rocked today on above ave vol. Clear sign of market – told ya! $$8:47 PM Sep 25th from web

3. NASDAQ: 135 NH’s today, the most in 2009 but we had more declining issues than advancers. Still suspect market $$9:13 PM Sep 17th from web

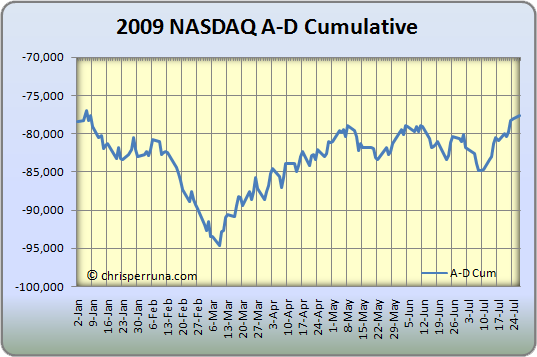

7. Markets near new highs but individual stocks are not making NH’s! Subtle divergence to watch. Adv-Dec is not making NH’ss either $$10:54 PM Sep 14th from web

8. $V – 72.87, another new high, more below ave volume.8:48 PM Sep 14th from web

17. $V – 72.31, hits a 52-wk NH but vol still concerns me. Holding but thoughts of cashing in creeping into mind. Up 30% since March (10 tweets)8:23 PM Sep 10th from web

35. Is the head forming in the market for a Head-and-Shoulders pattern ($SPX & $COMPQ)? It’s early but maybe…Time for bed! $$12:28 AM Aug 30th from web

47. The buy isn’t there yet but the inverse ETF’s can be a nice tool if the market drops, especially NASDAQ: $PSQ, $SH, $DOG, $QID11:39 AM Aug 19th from web

48. $GS – $160.48, has the same short term topping pattern as the NASDAQ on the weekly candlestick charts9:37 PM Aug 18th from web

49. @zaiteku However, the NASDAQ is weak. NH’s weak. Short term topping pattern & triple bottom breakdown. 200d is a nice support level $$9:21 PM Aug 18th from web in reply to zaiteku

56. Confusing market? “Keep cash if enough issues w/ such promise cannot be found or if the investment per issue becomes unwieldy” Loeb $$11:32 AM Aug 15th from web

*********************

See below for the complete list of my most recent tweets (100 total tweets – all dated and reproduced exactly as they appear on twitter).

The data in the below tables are compiled for the NASDAQ dating back to the 1970’s. I will admit that it doesn’t go back to day 1 in 1971 but it covers more than 30 years of new highs and new lows. Follow me nightly and weekly on twitter for my latest updates using this data in real time: Follow Me On Twitter

NASDAQ All-time

This first table shows us that seven of the top ten days with the most new highs came during the bull run of the 1990’s. The top day, Thursday, November 4, 1982 gave us the most NH’s all-time for the NASDAQ with 525 (only 13 new lows). The NH/NL 10-d MA Diff was 222, the NH/NL 30-d MA Diff was 196, the Adv-Dec Ratio was 1,087-469 and the NASDAQ closed at 225.01, up 1% for the day. The stock market bottomed on August 12, 1982 and rose 35 percent by the end of the year as we can see in the powerful NH/NL ratio averages listed above. The NH/NL 10-d MA Diff switched from negative to positive on Thursday, August 26, 1982 and never looked back (the tally was 180-15 that day); this was also the first day the NASDAQ NH/NL Diff popped above 100 since May that year. Talk about a market timer.

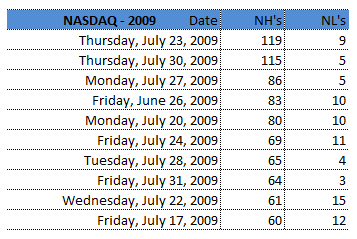

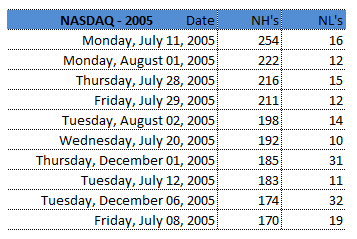

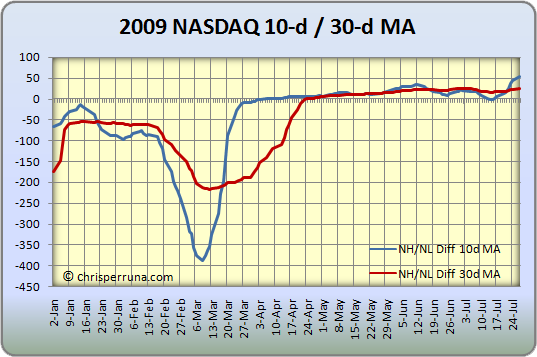

NASDAQ – 2009

The list from 2009 is freshest in our minds because it’s present day data. All but one of the top ten NH days for the NASDAQ happened last month with the 10th day happening at the end of June. It’s interesting because the ratio is getting stronger but the leaders aren’t cooperating and we aren’t “blasting-off” with 200 & 300+ NH’s as we did in the 1982 bull, the 1991 bull, the 2003 bull or the bulls of the mid and late 1990’s.

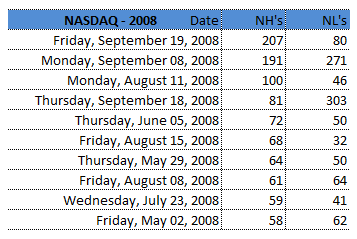

NASDAQ – 2008

We only logged three days above 100 NH’s in 2008, enough said. If you didn’t sell your long holdings and were still trying to pick a bottom, pay attention to this data next time; you won’t get hurt so badly!

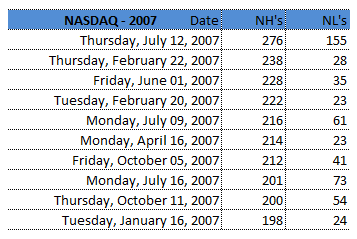

NASDAQ – 2007

The NH/NL moving averages sunk deep into the red by the fall of 2007, giving every investor the opportunity to lock in gains and prepare for the ensuing bear market. I’ve already “tooted” my own horn for writing multiple blog posts to lock in gains on this site in late 2007 and early 2008 (see here: Calling Tops and Bottoms: Trend Changes). More articles are listed below. The NH/NL 10-d MA Diff went negative on Tuesday, October 23, 2007, 10 trading days before the NASDAQ’s ultimate top. The index went on to drop more than 40% in one year and 55% to the bottom. Once again, pinpoint accuracy for the NH/NL data.

List of articles on NH/NL Data:

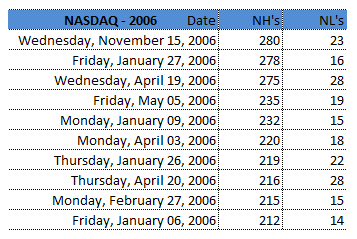

NASDAQ – 2006

Not much to talk about in 2006 – it was an average year with ups and downs but nothing drastic and not too much trending using this indicator. A drop in the markets took place in the summer of ’06 which the NH/NL’s picked up.

NASDAQ – 2005

This year was similar to 2006 as the NH/NL data was fairly quiet with no extremes in either direction.

NASDAQ – 2004

This year’s NH/NL data started off extremely strong with the second highest NH daily total ever for the NASDAQ. Nine of the top ten NH days came in January as the bull market of 2003 (recovery from bubble burst) was coming to an end. The market reached a top in January and didn’t surpass these levels until the following winter. January of 2004 gave us 6 days with a NH/NL 10-d MA Diff above 300, 5% of the total number of times this has happened to the NASDAQ over the past 30 years (128 total times).

NASDAQ – 2003

The bull market of 2003 gave us some of the strongest overall (average) NH readings of all-time. Wednesday, September 3, 2003 is the 8th highest daily total ever (only 2 NL’s that day for a 99% NH/NL ratio rating). The NH/NL 10-d MA Diff turned positive for the first time on Wednesday, March 26, 2003 while the NH/NL 30-d MA Diff turned positive on Tuesday, April 8, 2003. The up-trend started in March and blasted off in April, once again proving that the NH/NL data is pinpoint accurate – better than any stochastic, oscillator or other market tool available. We can’t argue with history.

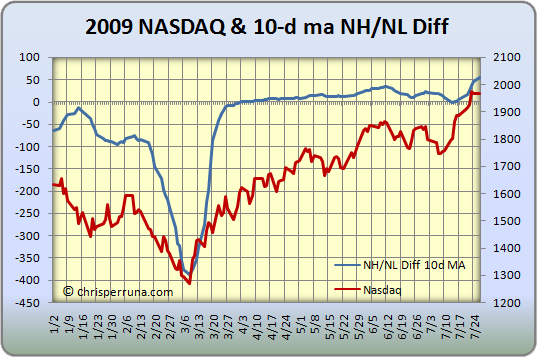

In closing, the difference between the past turning points and 2009’s turning point is that the former up-trends quickly showed many consecutive days of more than 100+ NH’s, soon to be 200+ NH’s per day. This year has failed to do that time and time again. Until it does, we’ll wait patiently and continue to watch the data, looking to pounce on the signal!

I hope you enjoyed this historical and educational post. If so, follow me on twitter for my nightly and weekly updates (the NH/NL data is the majority of my focus along with individual growth stocks): Follow Me On Twitter

Don’t forget to subscribe to my free blog feed so you can get my blog updates e-mailed directly to you or listed on your RSS home page.

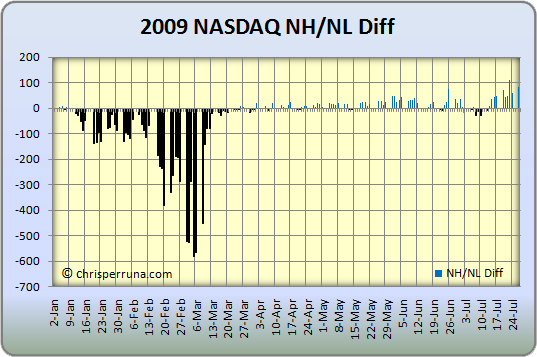

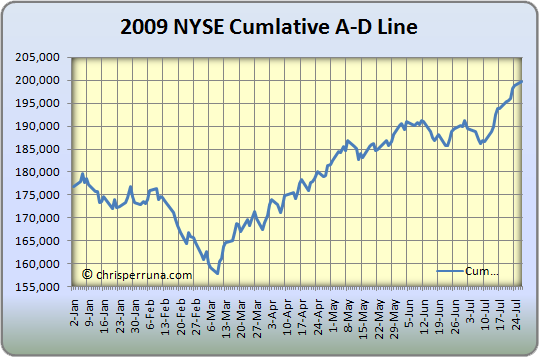

Market Breadth using the New High New Low ratio and the Cumulative Advance Decline line for the NYSE and NASDAQ.

I’ll let the charts do the talking…

Born and raised in New York but now living in New Jersey with a beautiful & loving wife, and two fantastic kids (boy and a girl). This site is about the stock market, success and life … [Read More...]

Copyright © 2025 on Genesis Framework · WordPress · Log in

Connect with Me