“I hear and I forget. I see and I remember. I do and I understand.” – Confucius

I placed a UWTI trade because I wanted to understand the decay first hand. Of course I could have done a mock-trade, a paper-trade or any other applicable simulation but would I fully understand the implications?

Of course I would but it always sinks in better (with me at least), when “I do it”.

Experiences last in your memory and experts say they influence future behavior. I may be able to argue that I wanted to “experience” the decay first hand so I would avoid these garbage products in the future and stick to products with less decay and daily expenses. I wanted to overcome my allure to the “3x” aspect of these products.

Here’s my trade:

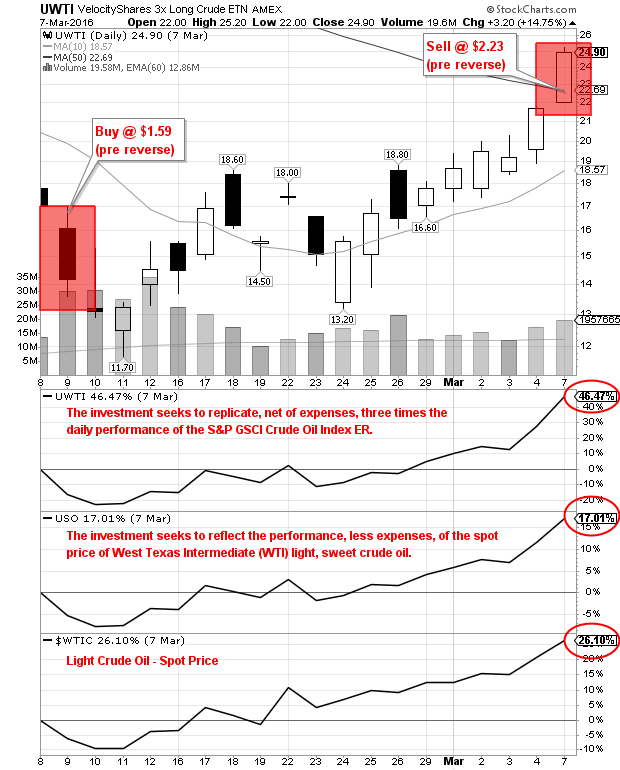

Buy $UWTI 2/9/16 at $1.59

Sell $UWTI 3/7/16 at $2.23

+ 40.2%

What’s wrong with a 40% gain? Nothing, I’ll take that gain over any 4 week period but in this particular case, the product did not provide a 3x return so I was robbed. A true 3x gain would have been closer to 80% but I knew, full well, going into the trade that substantial decay would occur if I held more than one or two days.

What is UWTI (VelocityShares 3x Long Crude Oil ETN):

The investment seeks to replicate, net of expenses, three times the daily performance of the S&P GSCI Crude Oil Index ER. The index comprises futures contracts on a single commodity and is calculated according to the methodology of the S&P GSCI Index. – Yahoo Finance.

As a comparison:

$WTIC was up 26.10%

$USO was up 17.01%

These results occurred during the same period (NOTE: WTIC was up 46.47% during this period as my entry and exit was not the exact open and close on 2/9 and 3/7).

What is WTIC (Light Crude Oil – Spot Price):

West Texas Intermediate (WTI), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. This grade is described as light because of its relatively low density, and sweet because of its low sulfur content. It is the underlying commodity of New York Mercantile Exchange’s oil futures contracts. The price of WTI is often referenced in news reports on oil prices, alongside the price of Brent crude from the North Sea. – Wikipedia

What is USO (United States Oil Fund):

The investment seeks to reflect the performance, less expenses, of the spot price of West Texas Intermediate (WTI) light, sweet crude oil. The fund will invest in futures contracts forlight, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels that are traded on the NYMEX, ICE Futures Exchange or other U.S. and foreign exchanges. – Yahoo Finance

NOTE: Most leveraged and inverse ETFs and ETNs currently reset on a daily or monthly basis and are therefore designed to deliver their stated returns for the reset period only (i.e., one day or month).

Moral of the story:

Unless a trader is positioning to make a quick gain within a single trading session, I suggest avoiding these decaying products. They carry too much risk should the trade go against your objective.

I was warned by other traders such as @howardlindzonand @ToddinFL to stay away from the decaying product but I needed the first hand experience (to make a personal mental impression on future behaviors).

I don’t see myself trading UWTI going forward but will take a look at USO based on my Crude Oil analysis posted back in February: How to Trade the Price of Crude Oil

Speak Your Mind