My high level thoughts are as follows:

Oil ($WTIC) will bottom out somewhere in the $20 range (when, I don’t know). OPEC is flooding the market with hundreds of thousands of barrels each day to force the price down to the point where most if not all American companies are forced to cease operations. The bankruptcies are already piling up from 2015 and will accelerate in 2016. Once the majority close shop, OPEC will pull back production and the price will increase (perhaps rapidly).

As it stands today, most American shale companies require crude to be at $60 per barrel to stay profitable. The leaders are getting by, by using efficient methods but the break-even point is still well above the current price level of crude oil.

Another thing we should watch is the proxy war between Saudi Arabia and Iran (hat tip to a friend on this perspective). When Iranian crude comes on-line, prices will drop again. Maybe that sends prices below $20 (unless already priced into the market, which it probably is). The United States and Russia will be squeezed tremendously, the question is, will the US bail out or prop up their oil companies (my guess is no, as that would be highly political, being oil companies). When gauging public opinion: propping up GM in 2008 is a lot different than bailing out the “big bad (& rich)” oil companies.

Bottom line: oil is not at the bottom yet and prices can drag along the bottom for a long, long time. But in the end, oil will come back up (it’s a matter of how long will that take). We just need to find the best vehicle to place this trade at the right time.

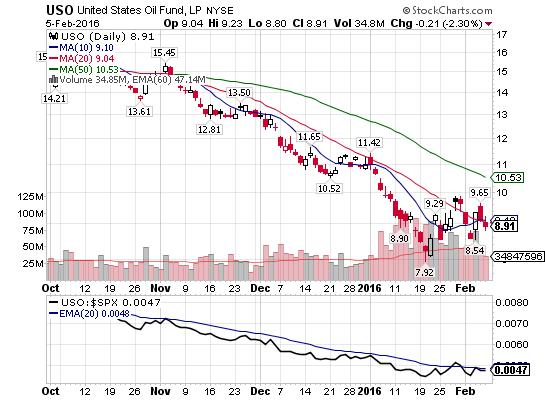

Do we do this using ETFs, leveraged ETFs (short term), futures, specific equities, etc.

Perhaps a combination of all of them, depending on the time frame of the trade.

I see crude a lot higher than it is today, 12, 18 and 24 months into the future but I haven’t determined the correct vehicle to make this longer term trade (ETFs decay, futures aren’t my game and individual equities are risky). I’ll keep you posted on my moves…

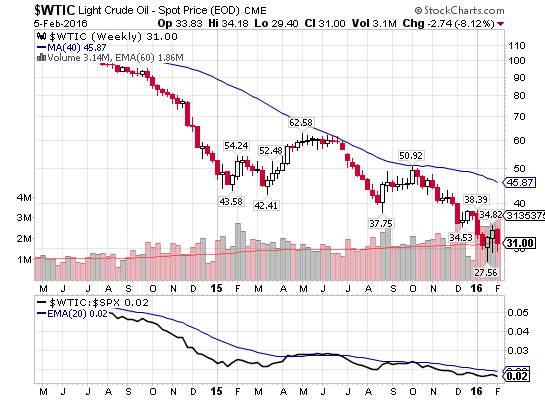

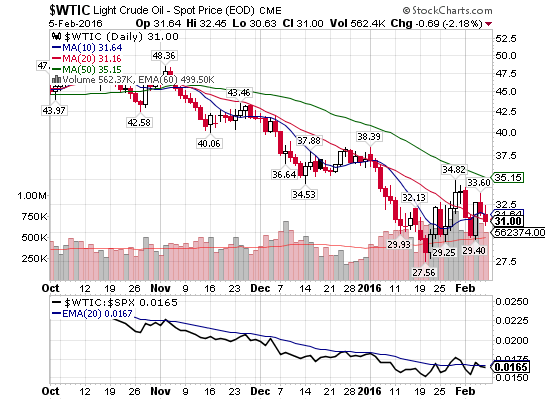

Charts: $WTIC $USO $UWTI $DWIT $XLE

Chris – we have missed your posts! Where have you been? I am curious to see your NHNL calculations through this market.

Iranian oil has been on the market for weeks now. Definitely keeping a lid on prices and flooding the market. One other thing about shale oil is with American technology and ingenuity those shale players can come on and produce much more quickly than ever before. If the prices start to go up we’ll have a tremendous “Oil Machine” ready to go. I honestly don’t think we’ll see $70 oil again in our lifetime.

No need for government intervention when we have XOM waiting in the wings to buy up all of the valuable assets that our country is flooded with. The firms that have financed the oil boom however is another story. The fallout from that is going to be severe as the bonds these companies have issued are not worth the paper they’re printed on. Many are trading 20-25% now foreshadowing their demise.

Should be volatile and great for trading though. Please keep posting and thanks for the website.

Mike

Your thoughts on closed end fund IRR?

Mike, I wouldn’t rule out $70 oil, not when the population is set to explode from now through 2100 (US, Asia, Africa, etc…). Sustainable tech is going to take decades to be fully implemented.

hello chris, I think oil is turning around. I own 3 value oil stocks . have you given any more thought to taking advantage of any change in trend? thank you

I like oil again in 2017 – will be highlighted on my 2017 Trends post.