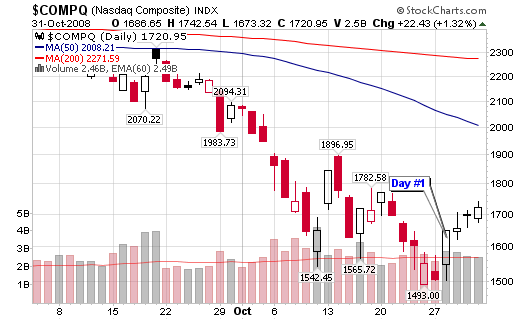

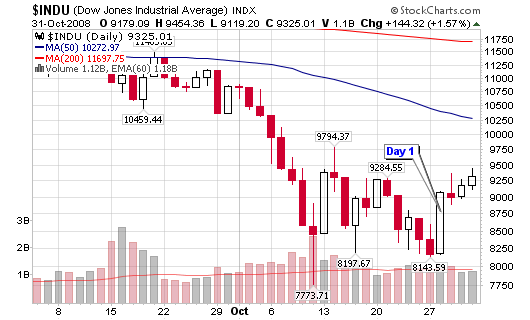

The market had one of its best weeks in months with day one of the pivot reversal confirming on Tuesday as described in Pivot Reversal – Day 1. The Dow closed the week up 11.3%, the NASDAQ gained 10.9% and S&P 500 edged higher by 10.5%.

Airlines, housing, real estate and oil & gas explorers enjoyed some of the biggest gains this past week but they are all still in the red for the year (the US Dollar seems to be the only one enjoying gains in 2008 – YTD).

The NH-NL ratio started to show some strength as the week unfolded with new lows decreasing from 748 on Monday to 49 on Friday (NYSE). The NASDAQ logged 544 new lows on Monday with only 82 on Friday. New highs are lacking across the board but only 6% of all stocks in the S&P 500 are above their 200-d m.a. so we can’t expect new highs to play a major factor in any of our technical indicators.

The second indicator we are watching, based on Martin Zweig’s experience, is the advance-decline indicator. I still consider this indicator secondary to the others but the importance in this type of a market is elevated. Monday’s market showed 679 advances versus 2,526 declines for a 3.7-to-1 negative ratio where as Friday’s market showed 2,308 advances versus 883 declines for a 2.6-to-1 positive ratio. We moved from a collective -1,847 on Monday to +1,425 on Friday and -1,847 to +1,861 from just Monday to Tuesday. Overall, I would have to say this is positive.

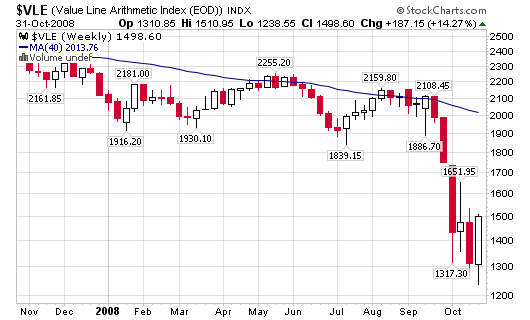

The Four Percent Model Indicator, mentioned on Monday, uses the Value Line Composite Index (Value Line Arithmetic Index (EOD) or symbol $VLE on StockCharts.com). Martin Zweig noted that a buy signal is generated when the index rises four percent or more from the previous week. Similarly, a sell signal is indicated when the index falls four percent or more from the previous week. The $VLE was up 14.27% for the week with gains of 8.2%, 2.1%, 4.3% and 3.6% from Tuesday on. That’s a buy signal if you ask me but please tread cautiously because this indicator is clearly secondary so wait for the follow-through from the Dow or NASDAQ.

The “up volume indicator” is the total number of shares whose price rises. As noted, Zweig has found that when 90 percent of the volume (excluding volume in shares whose price has not changed) is upward (9-to-1 ratio), significant upward momentum in the market is likely.

- Monday gave us a negative reading so we toss that.

- Tuesday (the pivot reversal day 1) gave us an almost 19-to-1 positive reading with 95% of all volume associated with upward movements.

- The following three days were positive but they didn’t cross the 9-to-1 ratio or exceed 90% with readings of 53%, 84% and 74% respectively.

All-in-all, let’s continue to wait for the follow-through before making a move.

Chris,

where do you find NH-NL and advance-decline data?

Is that something you calculate yourself?

Thank you.

Dima,

One place to go for free information is Yahoo Finance: http://finance.yahoo.com/advances

Information varies from one site to another – go figure. Stay consistent for research purposes.