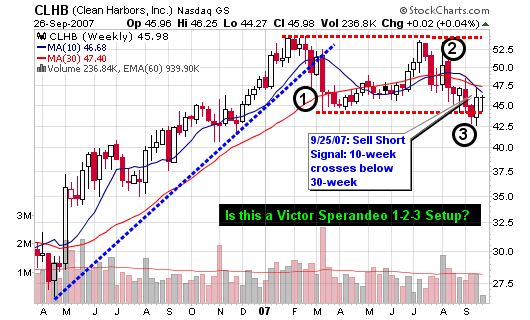

Clean Harbors (CLHB) looks to be setting up a 1-2-3 pattern as described in the book Methods of a Wall Street Master by Victor Sperandeo.

As you can see:

- CLHB broke the up-trend after establishing a new 52-week high.

- From there, it consolidated and formed what is referred to as the minor sell-off.

- Prices stared to rise but failed to make another new high. This test of the previous high failed near point number 2.

- A failure to make a new high is usually (not always) a signal that the trend is about to change.

- Finally, we reach point number 3 where prices went below the previous short term minor sell-off

However, prices didn’t continue to fall below this area so the position would still be established from the original penetration point. New investors should be looking for another penetration of the prior minor sell-off.

In addition to the 1-2-3 setup, the stock has also allowed it’s 10-week moving average to cross below the 30-week moving average which typically signals a change in trend when both lines are starting to point down.

Potential Trade Set-up:

Ideal Entry (short position): $45.00 (right now below the moving averages)

Risk is set at 1.0% maximum of total portfolio or $1,000 of $100k

Stop Loss is 6% or $47.70 (above moving averages)

Number of Shares: 370

Position Size is $16,650

Risk is $2.70

Target is $40 or less

Reward-to-Risk is about 2-to-1 (the target is a guess but I prefer at least a 3-to-1)

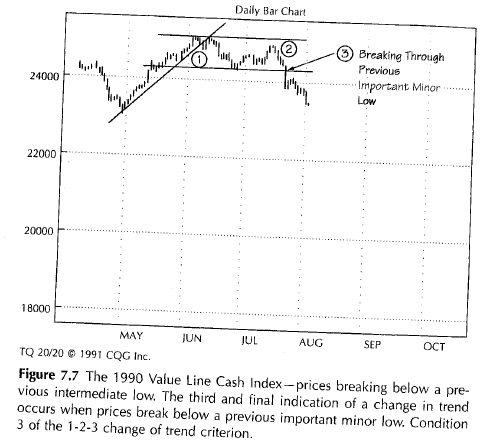

Victor Sperandeo says this about the 1-2-3 setup:

At the point where all three of these events have occurred graphically, there exists the equivalent of a Dow Theory confirmation of a trend change. Either of the first two conditions alone is evidence of a probable change in trend. Two out of three increases the probability of a change in trend. And three out of three defines a change in trend.

Take a look at the picture I scanned from Sperandeo’s book on page 76:

So, I’ll take the trade and see what happens. It can go up and whipsaw me out of the position but I have my stop and risk established so it won’t hurt the overall portfolio.

This is a game of odds with developed expectancies so take the trades and follow the rules.

Just say no to shorts in an uptrend! Chris don’t do it 🙂

Other than general market direction, it looks like a nice setup to me.

Jonathan,

I hear ya! But a successful setup is a successful setup for a reason. The reward outweighs the risk when looking at the P&F chart. I must take the trade. No “what ifs” in this business. I can’t be scared to take a loss.

I agree with you that this is 1-2-3, but isn’t the reversal to reclaim support on Sept 18 actually indicative of 2B?

I like this one too. I don’t like to short the market in an uptrend either. However, I am a bit skeptical of this rally. Take a look at the NH list and volume is pretty weak. AAPL, AMZN, RIMM, etc. I sold half my position in AAPL Thursday because it is looking tired. CHLB fell Friday after Chris’ post on higher volume. I’m in Monday morning with both feet. Mental stop loss if it closes above $46.96 (200 DMA).