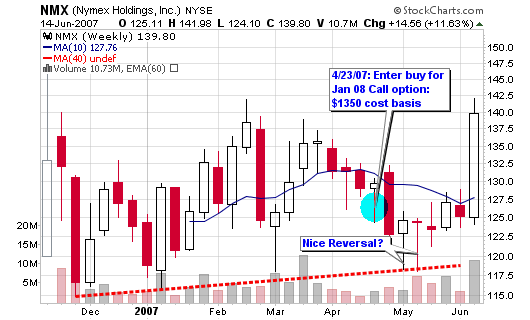

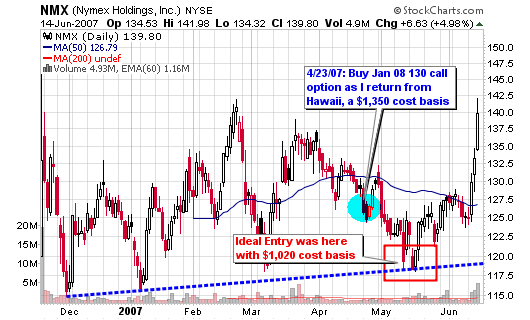

I wrote a post in early April, NMX Trading Decision: Shares or Options, and explained that I was looking to purchase call options: $130 Jan 08. I placed the order with a contingency but cancelled while on vacation because I didn’t want to worry about open positions that could hurt me. However, I did buy the 130 Jan 08 options when I returned from Hawaii but I paid a higher premium than I originally wanted. I ended up paying $13.50 for one contract or $1,350 cost basis (all I wanted was control of 100 shares for as little money as possible).

The options dipped to a low of $10.20 last week (stretching to my stop loss limits in my account) and I was about to pull the stop loss trigger but I sensed strength among the options in relation to the actual share price. In addition, I saw that the weekly candlestick chart showed two consecutive weeks of positive reversals above the young trendline. Therefore, I decided to stick with the position because my original plan was to hold until the early winter of 2007.

These same options blasted 100% higher over the past week and now show a 51% gain in my portfolio. The bid/ask closed at $20.20/$20.50 yesterday or total of $2,020. The stock is up more than $15 over the past three trading days and volume has exploded. With heavy action today, it will become the strongest accumulation week since the debut of the IPO (minus any unknown negative events). This is excellent action and can be a sign of things to come over the next six months so I will be sitting tight with my options. My research still shows a possible move to $170 by the end of 2007. This type of move would give the option a theoretical value near $40 (or $4,000). Early bid/ask numbers are in the $140 range so we will see where this thing goes!

The position could have been more lucrative if I had listened to my friend Ty who wrote this in the comments section of the original post:

“Hey Chris,

great post and research as always. I think the long calls could make a great play. You are probably going ATM or ITM (80-85 Delta?) I would guess, depending on where and when you buy it, but if you are going slightly OTM and you think it might take a while to move, have you considered doing a calendar? If you get an 08 with lots of extrinsic value, and its slightly OTM, you could sell a front month call against it and lower the cost of the 08 significantly. This could also work if it pulls back after you buy it and it looks like the pullback could be prolonged, like a month or so at least. You could sell a front strike 30 days or less out and collect some premium before it resumes its move. Just some “options” to go with your, options!”

That would have been great but I didn’t do it.

Here was my analysis and a few quotes back in early April 2007:

“Dealing with possibilities; NMX could make a 50% run over the next year based on institutional accumulation and the success of sister stocks such as CME, BOT & ICE. I am not in the business of predictions so I can’t tell you if NMX will follow suit.”

“So, instead of buying a lot of 100 shares for $13k, I am thinking about buying one January 08 call option (leverage my money for less exposure).”

“I am looking to place a market order for 1 Jan 08 call option with a current ask of $12.20 or $1,220 (for control of 100 shares). I am also thinking about placing a market order to buy this same call with one contingent: the actual asking price must be trading lower than $125 (good til cancelled) while I go on my trip. It’s not much of a difference so I may just place the trade after posting this entry but a further correction is also a possibility (down towards $122-125).”

UPDATE 6/15/07 9:35 am:

Nymex reportedly in talks to sell itself

NYSE Euronext, Deutsche Boerse, Chicago Mercantile Exchange said suitors

LONDON (MarketWatch) — Nymex Holdings share rallied in pre-market trades Friday on a report that the parent company of the New York Mercantile Exchange is shopping itself to larger rivals, according to a published report.

Nymex (NMX) , the world’s leading market for energy futures contracts, has held talks to sell itself to NYSE Euronext (NYX) (NYX) , Deutsche Boerse (581005) or Chicago Mercantile Exchange Holdings (CME) , Bloomberg News reported Friday, citing two people involved in the discussions.

Top Nymex executives have met with their counterparts at the three suitors, according to the report, and the board of Nymex has been informed of the talks.

Speak Your Mind