The stocks listed below are all trading within 10% of the 200-day moving average and have been leaders over the past year. Fundamentals are better than the majority of the peers in their industry groups and the technicals show potential opportunities. Many of the possible opportunities will struggle if the market takes a turn for the worse so please understand the “general market trend”.

They are not recommened buys so please do you own due diligence!

This screen is performed nightly looking for stocks that are trading higher within the set parameters. These include fundamentally sound stocks with increasing earnings, a gain during the day today and preferably a move on above average volume.

A Few Interesting Stocks within 10% of the 200-d m.a.:

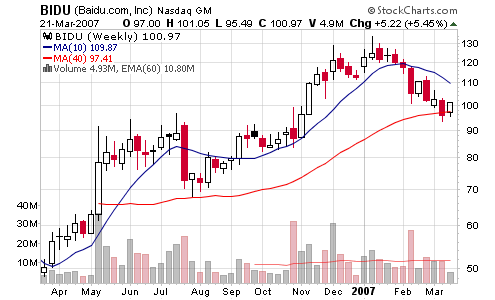

- BIDU – 100.97, the recent $60-$100 candidate has corrected from highs near $134 to catch some support at the long term moving average. The point and figure chart suggests positive action if the stock holds support

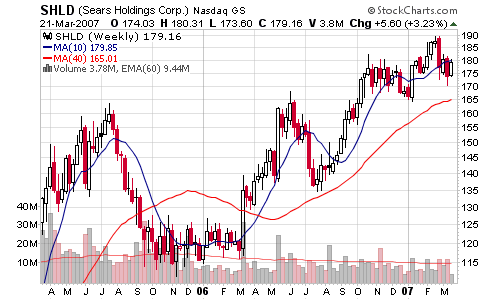

- SHLD – 179.16, the stock is consolidating once again but my ideal entry would be closer to the 200-d m.a. near $165.

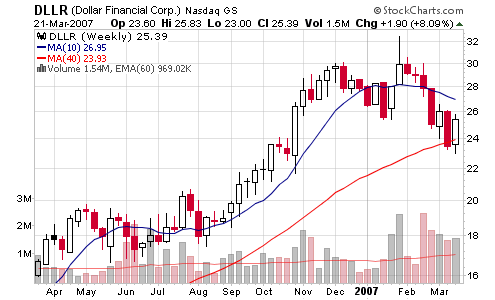

- DLLR – 25.39, the first correction to the 200-d m.a. since 2006. It will become an ideal trend buying opportunity if the support is held. Look for the RS line to reverse back to the up-side

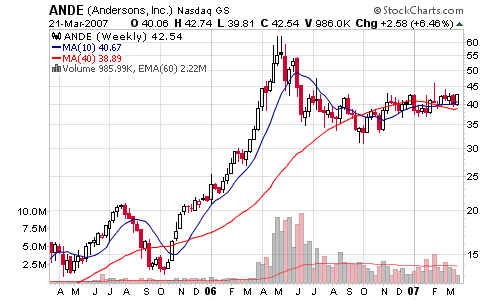

- ANDE – 42.54, the stock is trading flat to slightly higher over the past few months. Any rebound could take the stock back towards $60 (a nice risk-to-reward ratio)

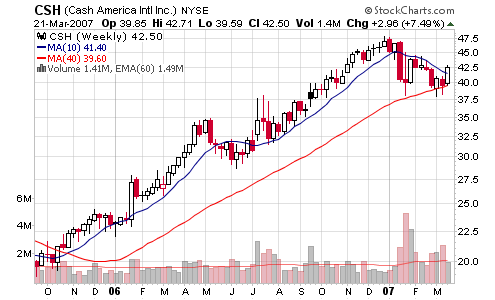

- CSH – 42.50, the recent superstar stock is finally touching the 200-d m.a. for the first time since 2005. Any support in this area is a solid trend buy

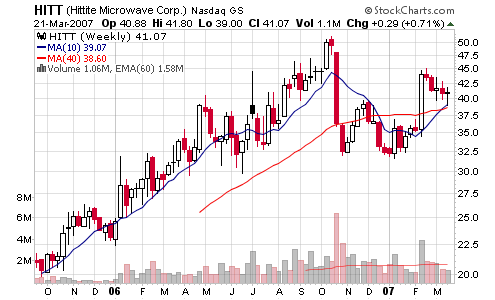

- HITT – 41.07, the stock is forming a basing pattern above the 200-d m.a. which shows some strength. The point and figure chart shows a negative trend forming but a move above $45 will reverse that outlook

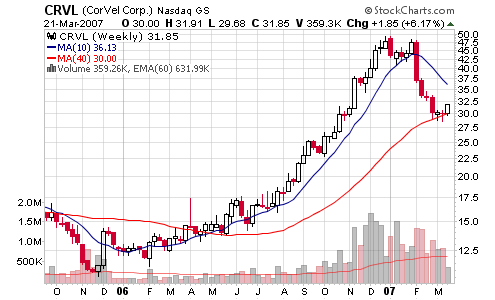

- CRVL – 31.85, the stock made a tremendous run from $11 to $49 but has recently corrected to the 200-d m.a. near $30. I am not sure if this is a dead cat bounce but support in this area will signal a potential basing pattern and possible opportunity

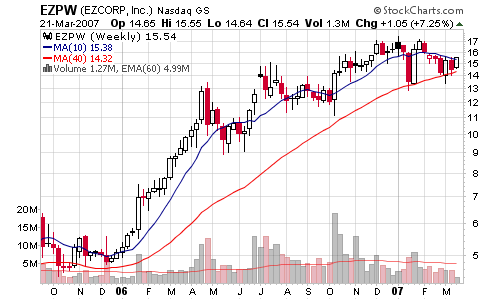

- EZPW – 15.54, the stock has caught some support three times over the past two months at the 200-d m.a. but volume has been weak. Possibly a cup or saucer shaped pattern above the long term average

Great post Chris! I’ve had SHLD on my watch list for a while now, ever since that breakout and reversal (which IMO was the market taking a beating) I’ve kept a close watch on it. Perhaps there is another opportunity to get in here soon!

Have a great day man!