As we all know the DOW set a new record close by finishing at 11,727.34, surpassing the prior closing high of 11,722.98 set back on January 14, 2000. The index was up 0.5% or 56 points as crude oil fell to a 14-month low based on assumptions that lower energy prices may boost consumer spending and hold off an economic slowdown. The NASDAQ was up 0.3% to close at 2,243.65 as it is still miles away from all time high that was set back in 2000 at 5,132.50. The S&P 500 closed at 1,334.11, up 0.2%, as it is within a short distance of its all-time high of 1,553.11.

As we all know the DOW set a new record close by finishing at 11,727.34, surpassing the prior closing high of 11,722.98 set back on January 14, 2000. The index was up 0.5% or 56 points as crude oil fell to a 14-month low based on assumptions that lower energy prices may boost consumer spending and hold off an economic slowdown. The NASDAQ was up 0.3% to close at 2,243.65 as it is still miles away from all time high that was set back in 2000 at 5,132.50. The S&P 500 closed at 1,334.11, up 0.2%, as it is within a short distance of its all-time high of 1,553.11.

With all of the excitement surrounding the new closing high, I would like to focus on what the “Talking Heads” are saying. What is a talking head? Please see a post I wrote years ago titled: Ignore “Talking Heads” because they are usually wrong!

With all of the excitement surrounding the new closing high, I would like to focus on what the “Talking Heads” are saying. What is a talking head? Please see a post I wrote years ago titled: Ignore “Talking Heads” because they are usually wrong!

Here are some quotes from talking heads today:

- “Now that you have a definitive new all time high, the fact that it is the Dow and the most recognized index, that is the type of thing that will shine the spotlight on the market,” said Charles Carlson, who oversees $105 million at Horizon Investment Services LLC in Hammond, Indiana, and who wrote “Winning With the Dow’s Losers,” published in 2004. “This could get people interested in stocks.”

Read that last quote! “This could get people interested in stocks”. The only people that get interested at this point in time is dumb money! When “people” such as your mother-in-law, the barber and the taxi driver start talking about the DOW and its all-time high; it’s probably time to get ready for a huge blow-out where smart money takes advantage of dumb money and laughs all the way to the bank. Be careful out there because the wheels will fall off when “people” get interested in stocks.

Another ‘talking head” on a major financial site:

Another ‘talking head” on a major financial site:

- “Investors are concluding that the economy is in for a soft landing,” said Hugh Johnson, chairman of Johnson Illington Advisors. “They expect the good news about the decline in oil prices to offset the negative impact of a deteriorating housing market.”

- “What’s most interesting”, Davidson said, “is not that the Dow has broken through to a new record, but that it has taken the market this long to get to a point at which stocks seem to be fairly valued relative to earnings expectations.”

Who cares, analysts were saying Enron was a buy and fairly valued at $60 before its infamous decline. By the way, talking heads recommended Enron all the way to $12 per share from $60.

Who cares, analysts were saying Enron was a buy and fairly valued at $60 before its infamous decline. By the way, talking heads recommended Enron all the way to $12 per share from $60.

- Scott Wren, senior equity strategist at AG Edwards was cautious about the importance of the Dow’s milestone. “It’s probably of more significance to the retail investment community than it is to the professionals,” he said.

- “But I do think its a psychological plus and one that could spark some interest and maybe bring a little bit of sideline money into the market.”

From MSW Money:

Twenty-three of 30 stocks in the Dow were higher on the day along with 304 S&P 500 stocks.

- The rally is a reflection of investor “belief in the sustainability of growth,” Maury Harris of UBS Securities told CNBC’s “Power Lunch.” While the economy may be slowing, it will be a modest pullback at worst, he said. And, added Peter Hooper of Deutsche Bank Securities, investors believe the Fed won’t be cutting interest rates but will step in to support the economy.

When I hear things like this, I start to lick my chops and get ready to short the hell out of the market. These talking heads don’t know what is going on and continue to pump a market and economy that is extremely extended and due for a pull-back. I really don’t know when that correction will start but it will and I am jumping on at the first signal. To be honest, it could take, three days, three weeks or even three months – I don’t know but when it does happen, I put my cash to use!

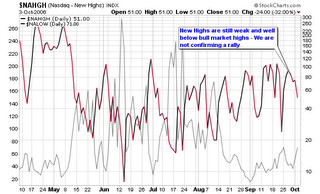

As many traders have noted, such as Trader Mike, the $SOX or semiconductor index is performing poorly which usually casts some foreshadowing of what’s to come. In addition to the $SOX acting poorly, small caps and other bull market leaders are not stepping to the plate to propel the indexes higher. The NH-NL ratio is weak and is not participating in this rally run and that sends the largest red flag in my opinion. Without the support of small cap growth stocks, you wouldn’t expect this rally to continue. I have been bearish on the Ticker Sense Blogger Sentiment Poll for the past four weeks as the market has moved higher and remain that way.

Some sectors acting poorly on Tuesday were energy stocks, computer hardware and gold stocks. Sectors moving higher Tuesday included airlines (they typically move higher when oil stocks move lower), brokers and some medicals.

Marvel Technology (MRVL) led the semiconductor group lower as it gapped-down and closed with a 12% loss on the largest daily volume in months. The stock is back below its 50-d moving average and is well below its 200-d moving average. The proper CANSLIM short should have come when the stock failed to recover the 200-d m.a. back in mid-June. Similar to the stocks listed on last night’s MSW screen, MRVL can be a poster stock for what to look for in possible shorts.

I have included some charts of the major indexes which shows why I am looking for a pullback and why my screens are focusing on potential shorts.

Piranha

Speak Your Mind