I’m always in search of trends that may offer solid investment opportunities (using individual stocks) but at the same time may not be “bleeding edge” technology. The best performing trend trading stocks don’t have to be unknown or highly touted IPO’s but rather they can be established companies. In searching for trends in 2015, the list of stocks I have developed is a combination of small growth, IPOs and established names.

So let’s identify a few trends that should continue to grow in 2015 and then identify a few stocks within each of these groups that could provide some upside. One caveat: the overall health of the market must be positive in order for the majority of these investments to do well.

Six trends come to mind:

- Cyber Security

- Biotech

- Digital Wallets (currency) & Mobile Payments

- Drones & Unmanned Aircraft

- Self Driving Cars (Future of driving)

- Social & Web based brands

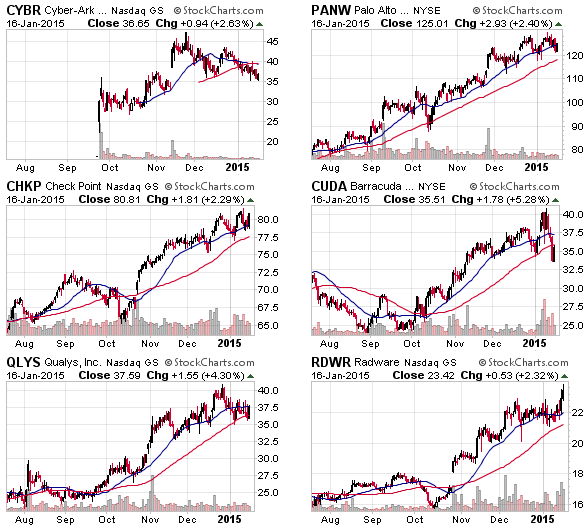

Cyber Security

$CYBR, $PANW, $CHKP, $CUDA, $QLYS, $RDWR

One of the obvious trends that should continue in 2015 is cyber security as breaches at major corporations around the world continue. Home Depot, Target, Staples, Michael’s and most recently Chick-Fil-A have all admitted to being “hacked”. And who can forget about the fiasco at Sony (whatever the real story may be). These companies and especially financial institutions must spend more money to protect their servers, clouds, data and integrity. This is precisely why I initiated a position in the cyber security sector in late 2014 and will continue to add to the position (at ideal risk / reward entries), using multiple stocks to diversify within this growing trend. One idea I have considered is building my own cyber security motif which would likely include several of the stocks listed above. Taking that idea further, a motif containing many of stocks listed in today’s overall blog post is a possibility as well.

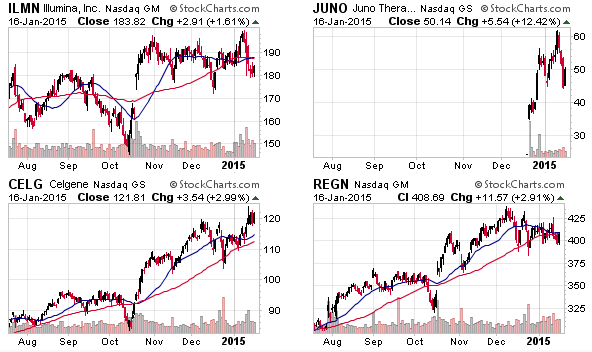

Biotech

$ILMN, $JUNO, $CELG, $REGN

The next trend that I like is biotech (a carry-over from 2014) and the big winner over the past several years has been Regeneron Pharmaceuticals. I have had the unique perspective of working with $REGN as they have expanded their headquarters in Tarrytown, NY; consulting for them (Real Estate & Construction) since January 2010 when the stock traded at $25 per share – it’s now trading above $400. Due to this professional relationship, I have mostly avoided talking about the stock on the blog and twitter.

With that said, I still like the broad sector. Illumina was a rock star in 2013 but traded mostly sideways in 2014. I liked the action in 2014 and view it as a long term flat-type base that looks poised to breakout above $200 per share. Sounds expensive, right? So did REGN at $100, $200 and $300 (after running from $25). $ILMN made a breakthrough in DNA sequencing and looks poised to continue that trend as well as expand elsewhere.

Next up is Juno Therapeutics, a biopharmaceutical company that engages in developing cell-based cancer immunotherapies. The company develops cell-based cancer immunotherapies based on its chimeric antigen receptor and T cell receptor technologies to genetically engineer T cells to recognize and kill cancer cells. Young IPO stocks are risky and typically like to build bases within the first year of trading but I am placing $JUNO on the list (use caution with first year IPOs). Cancer is not going away and the fight against it will continue to grow.

Both CELG and REGN can be added to a portfolio as their businesses continue to be cash cows.

Digital Payments (currency) & Mobile Wallets

$AAPL, $GOOG, $AMZN, $V, $MA

There’s a lot of talk about Bitcoin but I will stay more mainstream with digital wallets (currency) and mobile wallets that are currently in use. Think about it, how many of us use paper money anymore (I barely carry it myself). Perhaps people may say that I am not being creative with this group of stocks but I will continue to argue that they should be a part of every portfolio. Visa has been one of the best long term investments (consistency) of my investing life and I believe that they and MasterCard will stay in the mix and provide value within this space (internally and via acquisition). Apple, Google and Amazon will grow their core businesses but will also focus on this space as a huge revenue source as the world moves to a complete digital medium. Future IPOs are sure to stir the market as well: PayPal (2015 spin-off from EBAY), Square and AliPay (spin off from BABA).

Drones / Unmanned Aircraft

$AVAV, $TXT, $LMT, $LLL, $NOC, $BA

Drones and unmanned aircraft will explode moving forward but I am having a tough time finding stocks that allow me to invest confidently in this sector. One could simply invest in the big guys such LMT, LLL, NOC or BA (solid recent runs and they offer dividends) but I am in search of a cutting edge company specific to drones. The only companies that I have found to date are AVAV and TXT but I am not sold on these two “stocks” as being the leaders of the group. Indirectly, an investor could also consider AMZN and FB as drone stocks (one for delivery and the other for internet access). This market is not going away so I expect someone to step-up in a big way.

Self Driving Cars (Future of Driving)

$MBLY, $TSLA, $NVDA, $GOOG

I bought Mobileye after the IPO but was forced to sell for a loss (I was hit by that first year IPO pullback, after the initial run-up, which seems to be so common). Loss aside, I still see self driving cars as an industry that will expand exponentially in the future. However, I am not so sure that 2015 is the year (it may still be too early and the ultimate key players may not be at the forefront yet). When searching the universe for stocks to play in this area, MBLY, TSLA, NVDA and GOOG come to mind. Both MBLY and NVDA are creating technology and chips to lead the driver assisted market. TSLA and GOOG are developing the early prototype cars that use this type of technology to get the first self driving car on the road.

Side Note: NVDA was one of the first stocks I ever bought, back in 1999 while I was in college. AMD was the first stock I ever bought and it went from $38 to $90 in the matter of months (good old days). I wonder if the idea of NVDA popping up on my radar again signals another market top. I do have some scars from those early days.

Social / Web Based Brands

$FB, $BABA, $TWTR, $LNKD

The social web world is not going away and will only continue to infiltrate our lives, if it hasn’t taken over already. I wasn’t an early believer in Facebook’s stock and I was wrong (serves me right as I use the site daily). I was a believer in Twitter’s stock in 2014 but that turned out to be wrong. So much for discretionary trading! Revenues are increasing for Twitter so I believe the stock will follow at some point, once they figure out a way to turn a profit. I have always been a believer in LinkedIn due to the fact that I use the site extensively (business purposes). As for BABA, I can’t say I have firsthand knowledge but it seems to be a winner from China, one that looks poised to make a mark in the western word as well. All four stocks have a place in your portfolio, somewhere.

So that gives us roughly 30 stocks over six trending categories within the growth world.

As for other trends in 2015, I see a comeback (give it time) in energy / oil stocks (check $OAS, $SLCA and $FLT, among others) while former trends such as big data, 3D printing and smart retail ($NKE & $UA) will likely continue but they are not my primary focus at this time.

Lastly, an area I see tremendous value in is The Private Stock Market but that’s a subject for a separate blog post.

“The trend is your friend except at the end when it bends.” – Ed Seykota

I read you were considering a motif of cyber security stocks. If you go to http://www.motifinvesting.com/motifs/cyber-security1#/overview

there has already one been created that you can customize to your liking. You can buy a basket of CS stocks for one commission.

I am reading your Trader Spotlight in bclund’s ebook.