The past year has been very kind to IPO’s, the young growth stocks that will typically lead the market for years to come. With the NASDAQ up more than 90% since the March 2009 low, many have predicted time after time that it is far too extended to move higher. I have been one of those people, one that has been consistently watching for the possible Dow Theory Reversal (1-2-3 Setup). It hasn’t happened to date and the latest attempt to stall at resistance has actually propelled the tech laden index to move to new highs. The trend in higher until the charts tell us otherwise and always remember what Livermore said:

“Just because a stock is selling at a high price does not mean it won’t go higher” – this applies to markets as well.

Whatever the market will do in 2011, I decided it was prudent to point out a number of strong growth stocks, young companies that have debuted within the past year (many within the past six months). This is NOT a buy list but it is definitely a watch-list for anyone that searches to buy young, innovative companies that are growing both earnings and sales. Several, if not many, of the stocks listed below will lead the market from time to time over the next few years, A couple of them may even become household names, similar to the GOOG, BIDU and AAPL’s of the past.

As it stands right now, Sunday (night), December 12, 2010, the major market indexes are all trending higher in the short, intermediate and long term phases. Until that changes, grab shares at ideal low risk entry points. Enjoy the possible future leaders.

Future Stars: Young Growth Stocks to Watch in 2011 and beyond:

*All charts are listed below*

- HSFT – 27.46, only five months young, HiSoft Technology has currently pulled back to the 50-d moving average line, providing some support for a new entry or an opportunity to add shares.

- MOTR – 23.55, after a three-fold run from it’s IPO price, Motricity is consolidating back to its 50-d moving average for an opportunity to add shares or enter for the first time

- RP – 28.83, RealPage is forming a short term base that resembles a subtle cup with support above the 50-d moving average. A breakout to new highs will continue the up-trend.

- QLIK – 23.40, Qlik Technologies is has been trading mostly sideways over the past three months after nearly tripling from it’s IPO launch. A move to new highs would be positive for grabbing shares.

- MCP – 31.28, Molycorp is trying to maintain support at the 50-d m.a. after running from $14 to a high above $40 per share. The current consolidation is ideal to shake out weak holders and allow new supporters to jump on board.

- TSLA – 31.52, Tesla Motors has been all the rage in the automotive world over the past several months, partly due to it’s stock run from $17 to more than $36 in a few short months. A bit extended here but further consolidation to the 50-d m.a. will offer new opportunities to grab shares.

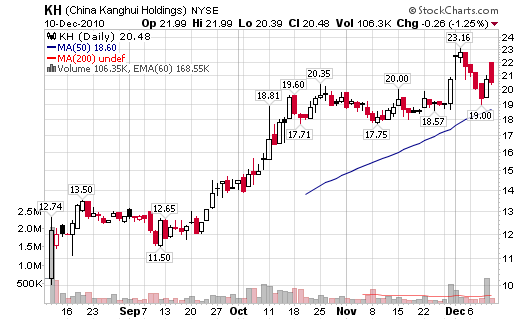

- KH – 20.48, some of my longer standing readers know I have had a long love affair with Chinese IPO stocks dating back to 2007 (BIDU, EDU, MR). China Kanghui looks like another solid young growth stock – always grab shares at or near a support level like a major moving average. Note this: other young Chinese stocks are starting to show sings of a breakdown so be careful.

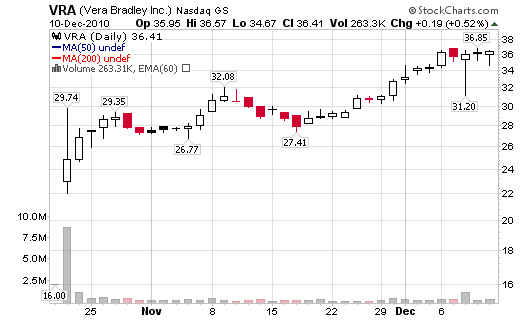

- VRA – 36.41, Vera Bradley makes my list because I know and understand this company, one of her bags was a recent gift to my wife. If VRA can be anything like Coach (COH), I’d love to jump on the ride now, nice and early. We can all dream for a ride like COH, extending back much of the past decade.

- ENV – 15.59, Envestnet is up over 80% since it’s debut. The ideal entry is along the 50-d m.a., similar to the pull-back in early November.

- OAS – 27.29, Oasis Petroleum is trending higher above the 50-d m.a. while continuing to make new highs. As with the others, an ideal, lower risk entry is a pullback on lower volume to the 50-d ma. The stock is slightly extended for that type of buy right now.

- IL- 19.60, IntraLinks Holdings has been trading in a $5 range since late October while consolidating back towards the 50-d m.a. with some nice intraday support on large volume in this area. Now is the time to grab shares if you feel the trend is higher.

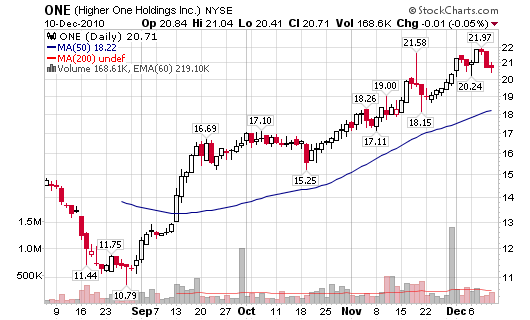

- ONE – 20.71, Higher One Holdings broke out in early Septmeber and has since run up nearly 100%. Solid support is down near the $16 area with moving average support at the 50-d (just above $18).

- ST, 29.00, Sensata is extended at its current price for an ideal entry but keep it on your radar for a possible pull-back on lighter volume (a consolidation near or slightly above the 50-d m.a.).

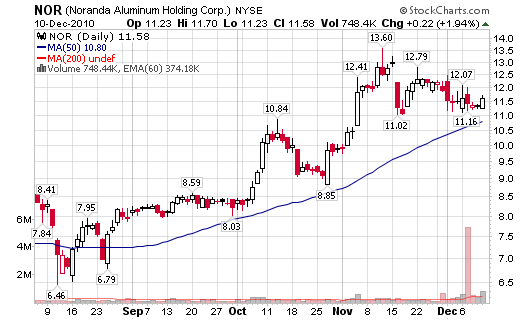

- NOR – 11.58, Noranda Aluminum Holding Corp. has doubled since its first consolidation after the IPO. Several buying opportunities have presented themselves at 50-d m.a. support (similar to the pullback occurring now).

- PRI – 23.85, Primerica is an interesting company that most of us has heard of but not many sign-up (at least that’s what we all thought). However, the stock is making a turn higher with a possible triple top breakout above $26, that’s the entry point to new highs.

- CHKM – 26.97, Chesapeake Midstream Partner hasn’t had the initial run as many of the stocks listed above but the run has a been a consistent 35%+ with entry points at the 50-d m.a., similar to the once current taking place.

- PDM – 19.31, Piedmont works in an industry that I call my “day job”. This stock will fly if the commercial office market picks up next year. I suspect this stock will move based on that market. It has a 35% gain for the year, not too bad for a company in a distressed market.

- FNGN – 17.92, Financial Engines took a beating after the IPO but has since started a comeback, advancing from a low above $12 to current highs near $18. A push to new highs with supporting volume will be a sign to grab shares.

Hi:

I wanted to thank you for providing such a vast, insightful information, particularly with P&F method.

Is there a way to start the subscription of your Alerts/Newsletter ?

Thanks and best regards

Sarah