Before we get into screening individual stocks, let’s refresh our memories and understand what we are looking for in the major market indices: We are looking for a market reversal or as Jesse Livermore called it, the pivotal point.

“Whenever I have had the patience to wait for the market to arrive at what I call a “Pivotal Point” before I started to trade; I have always made money in my operations” – Jesse Livermore, 1940

Market direction or the ‘M’ in CANSLIM as I have highlighted it in the past is the most critical characteristic to consider when investing. Seventy five percent of all stocks follow the general market averages with these numbers becoming more skewed in times of extreme pessimism (like now – 90% of all stocks are following the carnage).

Bear markets are necessary to help deflate the overvalued price/ earnings ratios and overpriced shares in times of extreme exuberance. Bear markets create widespread negativity, overwhelming pessimism, fear, uncertainty and a total lack of confidence among investors. Cash exits the stock market as people panic like sheep and prices start to adjust back to reasonable levels, paving the way to new opportunities around the corner.

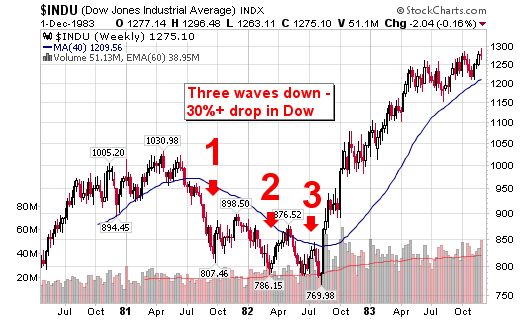

We are clearly looking for a new uptrend that sustains some life with a rally on above average volume. Bear markets will provide several head fakes as they typically fall in multiple waves of lower highs and lower lows. It usually takes the majority of stocks listed on the exchanges to sell off enough that a true base can form that will propel the next up-trend or bull market.

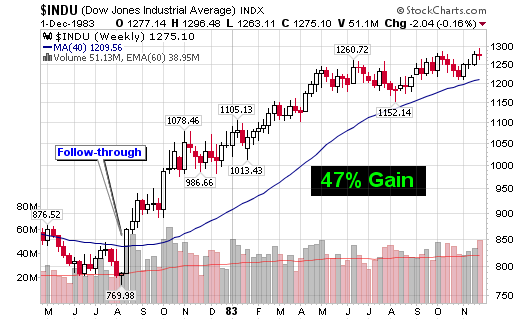

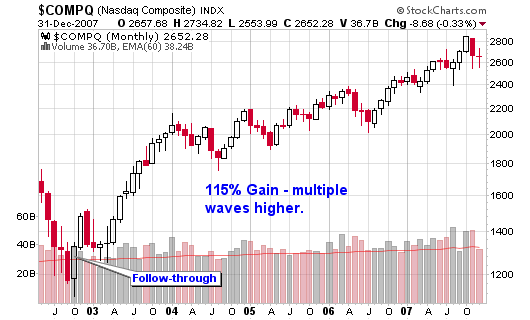

Study the charts below for the down-waves prior to the 1982 and 2002 bull markets. I selected these two years because they represent the strongest up-trends (bull markets) following a bear market over the past 30 years.

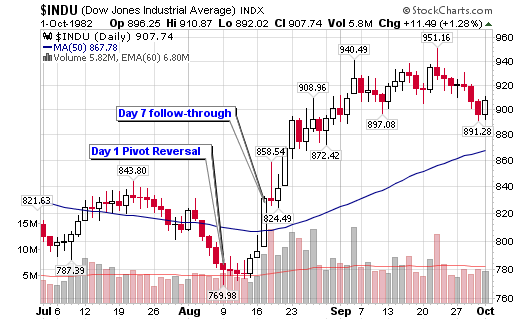

The first rally will feature one or more of the major market indices gaining at least 3% or more on higher volume than the previous day. It is then critical for at least one of these indices to follow-through with similar action four to ten days later (preferably four to seven days later – rules from original O’Neil books).

We won’t be able to tell if the market is building a rally after the first 3% up-swing so give it time and look for at least one, if not multiple follow-throughs from the four day on. The more, the better. Markets will give head-fakes about 1/5th of the time after a true follow-through so we will pay careful attention to the number of waves down during the current bear market. We have had three waves down but only one major wave down on the DOW (it could go lower – easily, before moving higher).

See charts below for the pivot point reversals and follow-throughs for the 1982 and 2002 bull markets.

We must understand that head-fakes and multiple pullbacks are clearly in the historical descriptions of former bear markets. I don’t quite know if the current markets have had sufficient pullbacks before launching a new up-trend (see the charts of the DOW and NASDAQ from yesterday’s post).

What I can tell you is that bear markets typically end while the business cycle is still suffering. With our media, this sucker will last forever – a bunch of useless talking-heads. Why does this happen? Because the stock market is discounting events three to six months in advance (long time readers of the blog know I believe this more than most theories of the market – I consider it fact).

Whether you read William O’Neil, Jesse Livermore, Martin Zweig or Gerald Loeb, they have all confirmed over the past 100 years that no bull market has ever started without an explosive price and volume pivot reversal and follow-through.

The charts displayed today show markets with a pivot reversal and a follow-through – the exact scenario that will take place when the next bull begins and this bear comes to an end. As William O’Neil always says: “The big money is made in the first one or two years of a normal bull market cycle”

Fantastic post Chris, I think I am going to upgrade my stockcharts.com acct so I can actually view these historical charts and patterns.

Do those books of yours bring up 10% rallies when consumer confidence hits record lows?!

Blain,

Thanks! I feel refreshed after my blog break and ready to kick some market ass.

Do note that the historical data doesn’t go much further than the early 1980’s for stockcharts.com, at least for annotations. They have large historical charts going back to 1900 if you want but they are huge files.

Hey Chris,

I was looking for an email to get in touch with you but was unable to find one.

Anyways, I work for wikinvest.com and was wondering whether you could shoot me an email. We just launched a new service and was wondering whether you would be interested about it. You can learn more about it here:

http://www.wikinvest.com/blogger/Wikinvest_wire

Regards,

Waseem

Hi, by looking at those charts, they all seem to make a new low (relative) before starting their uptrend… in our market, that would mean ‘new lows’ (below 839 on the s&p). We have had 3 good reversal/up days in the month, but i still have a feeling that we test those lows due to redemptions/recession/CDS settlements. That is, unless we see an 87′ type floating around a while before slowly moving up. Whats your take.

hi chris,

great post.

but can you explain the idea of the pivot reversal a little bit more. i’m not sure that i would be able to recognize it by myself. what is the main characteristic?

thanks!

daniel

Daniel,

See today post for an exmaple:

http://www.chrisperruna.com/2008/10/29/pivot-reversal-day-1/

Anon,

Maybe the lows will test but don’t “think” you know what “should” happen. Follow the tape. Times are tough and the market is weak (no individual leaders) so this new rally attempt may just be a reversal. We’ll see. Do nothing yet.