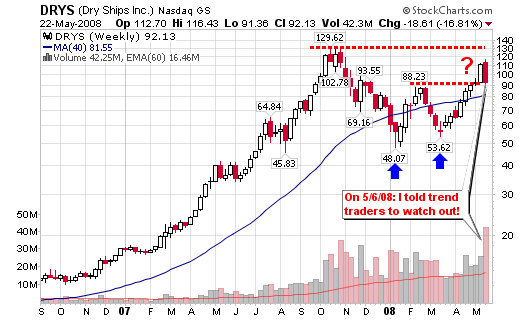

Well, DRYS is now down 16.81% this week and volume is peaking at the largest level we have seen in years – huge distribution!

This is what I had to say a few weeks ago in my post titled DryShips (DRYS) Drying up?

All in all – I am not a buyer of the stock at this level. It may be a solid short term buy for traders that make these types of plays such as Blain and Rajin but it does not fit into my criteria for a trend trading opportunity.

I see a decent consolidation over the past few months but I have a problem with the current pattern that is forming if it does not test former highs near $130. Volume is increasing as it moves higher but the stock is starting to struggle near the last peak of $88.

I stick to my original analysis as I am watching the stock from afar or the weekly chart. I am not day trading DRYS or any stocks for that matter so I can cut through the noise and view the market on a weekly basis to assess the “true overall trend”. Don’t get me wrong, many traders made money on the recent spike in DRYS but I wasn’t touching it with a 10-foot pole. I look for the big runs and couldn’t be bothered with a few points here and there (and I am not about to support my broker with constant buy and sell commissions, even if they are minimal).

The easiest way to characterize this trade and the market in general is to view it all as a risk/ reward potential or an expected value, as I wrote yesterday. DRYS was not a +EV trade in my trading system but, it very well may have been an excellent +EV trade for a shorter term day trader such as Rajin or Blain.

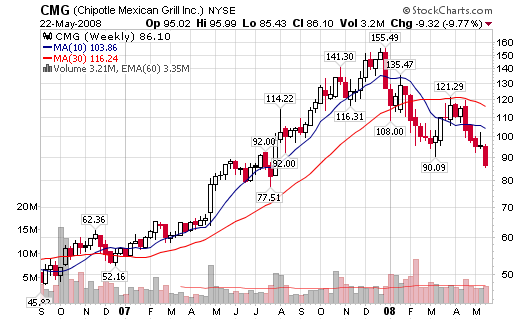

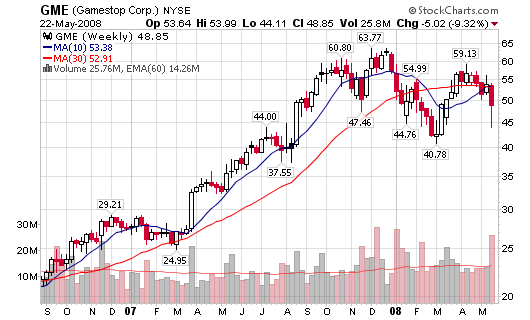

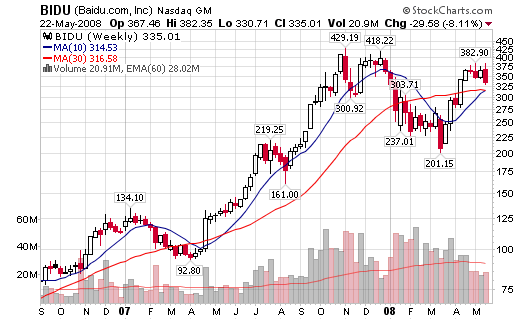

Anyway, here are a few more charts that are starting to look suspicious (some more than others). The bottom line or point of today’s rant is the fact that I still feel that the market is headed for a decline or as I phrased it a couple weeks ago:

The Big Decline (long term perspective of course).

These charts are just examples as many more exist but they were some of the first I viewed Thursday night:

Crazy china shipping IPO: SINO wish i knew about it 2 days ago.

Hi Chris….The runaway oil train is moving full steam down the tracks. Soon it will be moving so fast it will leave the tracks and crash, unfortunately taking the entire market with it. I’m with you on the big decline.

Hi Chris

Standing at the krap table,looking at the charts, what would think the best put action would be,as a small roll of the dice.Reading charts for about 1 year(rookie,me) I would guess that GME on a low voulme bounce toward 55.What is your take and how far out would buy them.

Thanks for your writing

Angelo

Don’t worry about what happen I shot myself in the foot plenty of times,I’m always to early,but I working on that.