“Higher oil, rate-hike fears and new regulations in the financial sector handed stocks their biggest beating in nearly a month…”

– Stocks Get Hit In Heavier Volume, By Vincent Mayo of Investor’s Business Daily.

There is some truth to the statement above but the charts have clearly been raising red flags that this market may be heading lower. I highlighted this trend over the past week or so I as I started to see the same faulty charts appearing on my screens. Visit these posts to see what I have been saying over the past week:

- The Big Decline

- DryShips (DRYS) Drying up?

(By the way, DRYS was down 2.87% on above average volume – distribution)

The NASDAQ, DJIA and S&P 500 fell about 1.8%, 1.6% and 1.8% respectively as crude oil was up $1.69 to close above $123 a barrel (a new record).

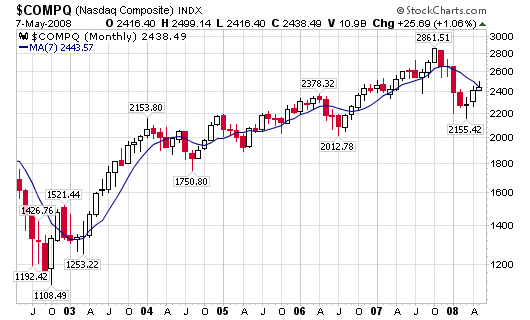

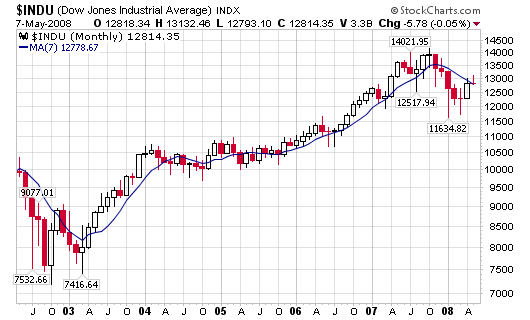

I originally started to point out market troubles back on March 14, 2008 in a post titled Snapshot Friday; I highlighted both the Dow Jones and NASDAQ with clear yellow shaded areas showing the 200-day moving averages pointing down for the first time since 2003 (that’s huge if you ask me).

Yes the market is now higher than it was in March but the recent bounce is smacking up against the 200-d m.a. for the first time since 2003 for both indices. The last time the market crossed below a down-trending 200-d moving average and couldn’t recover was back in 2000 and 2001.

So what does that mean? As I said yesterday, I think it means a possible Big Decline.

The Dow Jones is now back below the 200-d m.a. and is failing to challenge recent highs. The day’s action came on above average volume which makes today pure distribution.

I hate to pick tops but we may be coming off the official top of the bull market that lasted from 2003 to 2007.

Chris, in this weak market, some stocks that you mentioned on your blog before still good buy? such as TITN and TTEC… Thanks.