What else can I write about after the major indexes dropped 2.93%, 3.08% and 3.20% (DOW, NASDAQ and S&P 500)? Volume wasn’t overwhelming for the day but peaked during the hours of the major decline. The first two days of this week have basically wiped out all of the gains from last week while the S&P 500 has now recorded its worst year-to-date start in the index’s history (according to Investor’s Business Daily).

Avon Products, Church and Dwight and Apollo Group were among the stocks making a positive move this week. These are not the stocks you want to lead a strong market (we all know it’s far from strong). Cosmetic, personal care, household and education industries are all related to defensive moves for investors. Run for cover from the former leaders when these stocks rise to the top.

However, the names below may provide for nice safe havens while this market sorts itself out. Their relative strength ratings are holding steady and their declines from recent 52-week highs (some at all-time highs) are rather impressive when compared to the fallen leaders that are now off by as much as 60%. Even long time superstars such as AAPL are off by almost 40%, GOOG by 30% and MDR by 30%.

Will Institutional Investors park Money here?

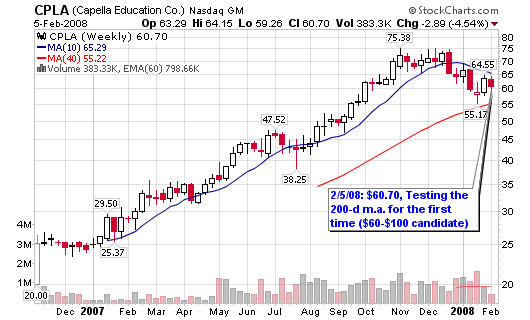

- CPLA – 60.70, a primetime $60-$100 candidate as the stock corrects back towards the 200-d m.a. for the first time ever. A nice moving average (accumulation) buy – not far from all-time highs

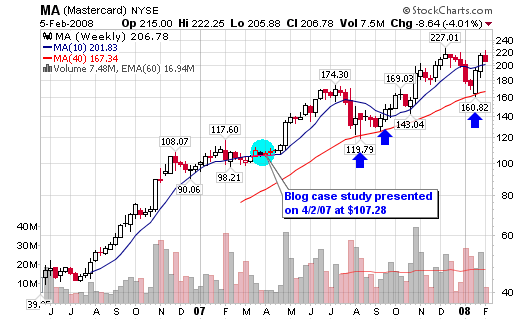

- MA – 206.78, even with the credit crisis, this stock is within a few dollars of its all-time high. Continue to accumulate shares along the long term moving day average. Remember, MasterCard isn’t responsible for default loans (the banks are).

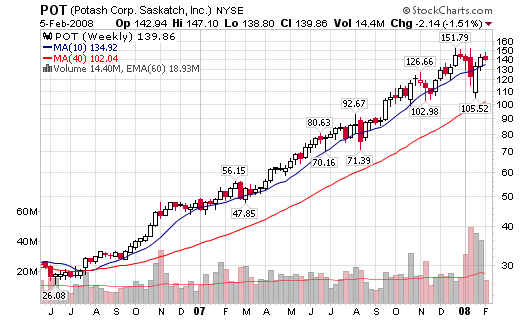

- POT – 139.86, what was I smoking when I passed up POT on numerous buying opportunities in 2007. I guess I can realistically say that it never pulled back to the 200-d m.a. so it slipped my best risk/reward screens. Still a place for funds to park money

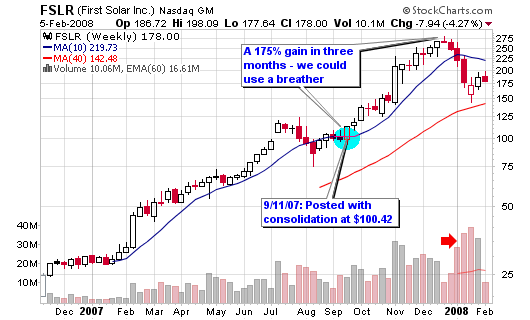

- FSLR – 178.00, the stock has corrected by 50% since hitting its peak but it is still holding the 200-d m.a. strong, a sign of institutional sponsorship

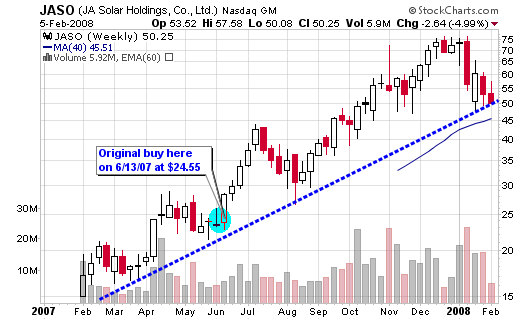

- JASO – 50.25, still a nice play as it challenges the 200-d m.a. for the first time since the IPO debut last February. The Olympic hype, solar angle, IPO aspect and increasing earnings should keep this one flying.

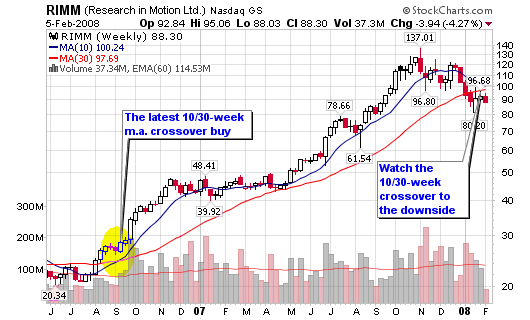

- RIMM – 88.30, the blackberry stock has corrected back to the 200-d m.a. for the first time since 2006. The correction is welcomed so let’s watch to see if it can hold the line. A nice accumulation area if it holds its weight. Keep an eye of the 10/30-week crossover to the downside (a negative signal).

None of these stocks are recommended buys when the “M” in CANSLIM is weak but do keep an eye on them and accumulate when you find the best risk-to-reward setup and a sign of life in the market.

Chris,

thank you for a nice post.

What do you think of recent action in GRMN??? The stock dropped 50% from its all time high.There was no suport at either 50 day nor 200 day moving avergaes.Moreover,50 dma recently dipped below 200 dma.However, garmin looks like a solid company to me. Leader in its field, introduces new products (Nuviphone), has no debt. Any thought where it might head in the upcoming months?

Thank you.

Dima,

I try to trade the stock, not the company. The stock is hurting so I am just not interested. I love the company and products but the 50-d below the 200-d is an absolute “no buy” in my book of rules.