Stock of the Day

FCStone Group Inc.

Friday’s Closing Price: FCSX – $47.96

Sector: Financials

Industry: Investment Brokerage

52-week Price: $27.25 – $48.70

Next Earnings: 7/14/07

FCStone Group is another financial stock making its way to the “stock of the day” case studies here on the blog. Our most recent financial stock covered, GROW, decided to pop on Friday on heavy volume which was good news to everyone that established a position.

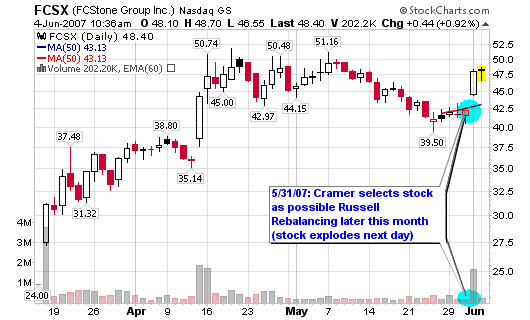

Today’s stock made my IPO screens over the weekend and saw a strong pop on Friday after Cramer noted it as one of his three stocks that may be part of the Russell rebalancing later this month. I was actually watching the show live when he named the three stocks and took a quick look at their charts but didn’t go further with my research at that time. The strong $5.67 price move along with the 358% increase in volume on Friday easily allowed it to make my weekend screens. Both the EPS ratings and the RS ratings (my main criteria for the screen) look extremely healthy so I decided to dig deeper.

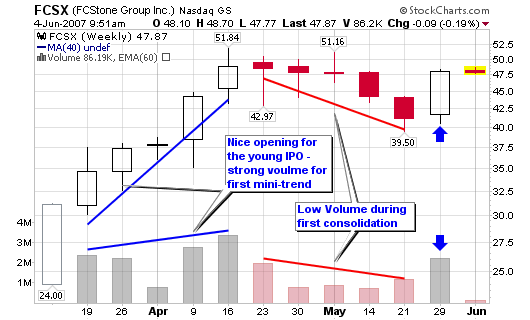

The financials are below so I will start with a brief analysis of the daily and weekly charts. The weekly charts shows the stock blasting out of the IPO with a strong up-trend that lasted six weeks on strong volume. The stock consolidated over the next five weeks but volume was lower, a very positive sign. Institutional investors were holding their shares while the little guy was buying and selling.

You can see the sharp price increase above the 50-d moving average on strong volume Friday, the morning after Cramer’s buzz. Aside from the Cramer buzz and the possibility that FCSX may land on the Russell 2000, the stock is definitely one to watch from both a fundamental and technical standpoint. Due to a lack of trading history, we don’t have an ideal entry for a trade setup. Therefore, we must look to accumulate shares at or near the 50-d moving average or a new all-time high on strong volume. Look to add shares if the stock is closing the gap from Friday near $42.50 (see my potential trade set-up below).

Potential Trade Set-up:

Risk a maximum of 1% of portfolio

Set a stop loss near $39.10 or higher (7-10%) with entry near $42.50 gap-up

Target of $63+ based on previous high to low action (pure speculative target)

Risk to reward has a potential of 6-to-1 based on exact entry, target and stop listed above.

Use my position sizing spreadsheet for alternate setups.

Key Fundamental Numbers:

Market Cap.: $850.2M

Outstanding Shares: 18.24M

ROA (%): 1.72

ROE (%): 48.77

P/E (TTM): 32.90

P/E (Forward): 29.88

PEG Rato: 1.94

Price to Sales Ratio: 0.55

Price to Cash Flow: 37.80

Price to Book Ratio: 18.06

EPS Growth (TTM): 81.86%

EPS Growth (MRQ): 75.26%

Revenue Growth (TTM): 28.47%

Revenue Growth (MRQ): 50.06%

Earnings:

Yearly (2008): 1.76E

Yearly (2007): 1.59E

Revenue (millions):

Yearly (2006): 1,295

Yearly (2005): 1,402

Yearly (2004): 1,624

Yearly (2003): 1,233

Yearly (2002): 896

Institutional Analysis:

Held by Institutions: 8.31%

Total Institutions Holding Shares: 43

***Additional data in this section will be added later as my service provider for institutional info is currently down***

Company Profile:

FCStone Group, Inc. (FCStone) is an integrated commodity risk management company providing risk management consulting and transaction execution services to commercial commodity intermediaries, end-users and producers. It assists primarily middle market customers. In addition, to its risk management consulting services, FCStone operates an independent clearing and execution platforms for exchange-traded futures and options contracts. The Company serves more than 7,500 customers and as of May 31, 2006, executed 44.3 million contracts in the exchange-traded and over-the-counter (OTC) markets. FCStone operates in four segments: commodity and risk management services (C&RM), clearing and execution services, financial services and grain merchandising.

Hi Chris. I stumbled across your blog a couple of weeks and I really enjoy it. For today’s stock of the day (FCSX), can you describe how you came up with the $42.50 entry point?

-Al

Al,

The $42.50 “ideal” entry poitn comes in the area of the gap-up after last Thursday’s close. The 50-d moving average also resides in this vicinity. More times than not, the gap will fill and then the stock will move higher. So, ideally, I would enter in this area but shares can be accumulated along the major moving averages (right now, that is the 50-d m.a.).

The gap-up from April never filled so keep that in mind.

like this one too – broke out of the short handle of the short base. One of my better trades today. What I’ve noticed with IPO’s is that bases are often short lived so its important to make adjustments there.