The Big Picture examined an article titled, Why Market Optimists Say This Bull Has Legs, which made the front page of the Wall Street Journal Wednesday. Barry Ritholtz named his blog post “Uh-Oh: Front Page WSJ” Why Market Optimists Say This Bull Has Legs” and says: “In the past, that has operated as a bit of a warning sign that an intermediate top was nearing.”

I first read about this post from Trader Mike’s Recent Links which is an invaluable part of my routine in scanning top blog posts and financial stories of the day.

I am not sure if this WSJ article will signal a top but I tend to agree with Barry that this type of front page coverage has a history of signaling things to come. Experienced investors know that these articles don’t signal what they are speaking about but actually the exact opposite. A contrary view of front-page publishing; based on basic human nature.

Many of you may be familiar with the old theory commonly named “Magazine Cover Indicator” which typically signals that a company’s trend will be coming to an end or pause after the CEO appears on the front page. This also seems to be true when a company decides to build a new state-of-the-art corporate facility. In any event, let’s take a look at some technical analysis to see if we believe the market may be nearing a top or a brief pause.

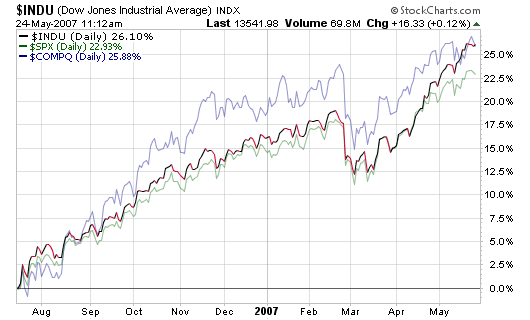

Looking at this first chart, we can see that the three major indexes are all up more than 20% in less than a year. I don’t see a sell signal by looking at this chart and actually like the fact that the market did take a breather in late February and March of 2007. I am not one to sell for the sake of selling but I do keep an eye on this performance chart to make sure the up-trend doesn’t extend too far without a natural pullback.

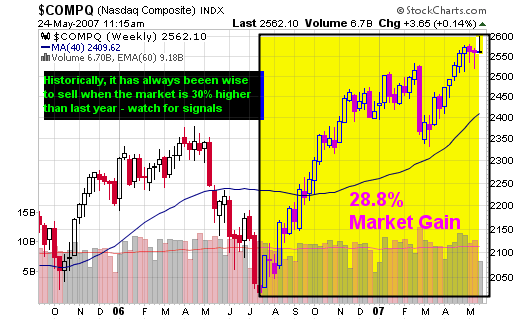

The second chart shows the NASDAQ reaching a 28% gain over a year ago which has signaled tops in the past. Eugene D. Brody, from Oppenheimer Capital, was quoted as saying: “Sell stocks whenever the market is 30% higher over a year ago”. Again, don’t sell for the sake of selling but watch for signals and major red flags. Maybe you should place physical stops instead of mental stops as we approach the quiet summer months.

Historically, June and July have been good months in pre-election years but August is usually a poor performing month according to the Stock Trader’s Almanac. Price and volume will be the ultimate barometer of the market’s condition so keep all of these things in mind but never act unless the market sends a true signal and/or confirms your beliefs.

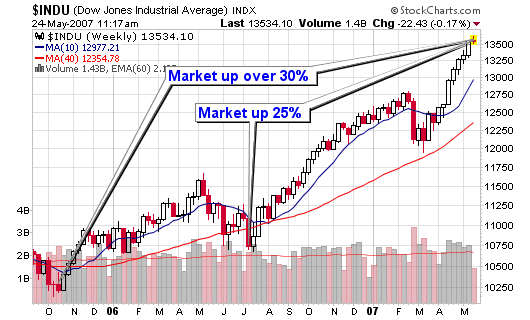

This final image displays the weekly chart for the Dow Jones Industrial Average which has gained 30% since October 2005 and 25% since last summer. We had a brief pause in the up-trend in the summer of 2006 and then again in March of 2007 but other than that, the index has been phenomenal while setting multiple all-time highs. We are now extended from both the 50-d moving average and the 200-d moving average so look to these areas as support or violation signals. The 200-d moving average carries more weight in determining if a trend is about to reverse.

Keep this quote in mind when looking for tops and bottoms:

“You try to be greedy when others are fearful, and fearful when others are geedy”

– Warren Buffett.

When the crowd gets greedy, the top is just around the corner and I don’t think we are there just yet! Ride the trend until it ends and don’t try to predict the top.

Chris,

Thank you again for your warning sign!!

Because your signs have been pretty important indicator for me, i am very concerned with my market involvment at this time. Just like many traders, i am bearish about the market, yet my portfolio is fully invested. Should i get rid of some of the shares i have??

Only sell shares if they hit your stops. Don’t sell for the sake of selling! If anything, take a portion of your profit if you don’t feel comfortabel (maybe 1/2 or 1/3 off the table). But again, don’t sell for the hell of it because you can’t outsmart the market.

These numbers bear out on the Nasdaq. I did some historical testing and calculated the year-over-year % return and then calculated the % return over the next 1-month, 2-months, 3-months, 4-months, 5-months and 6-months. I then determined the correlation between the two.

In each case, there is a negative correlation and the relationship gets more negative the longer the time frame. This is true for all historical data on the Nasdaq and using a more limited time, beginning March 2003.

I just checked the NYSE, SP-500, Dow, Russell 1000 and Russell 2000. The relationship on all of these indexes is statistically significant, and there is a negative correlation. The higher the year-over-year % return, the smaller the gain 1-6 months out.

Oops, a copy and paste error led me to make some erroneous conclusions. Let me fix them right now.

Starting March 2003, on the Nasdaq, SP-500, Dow, NYSE, Russell 1000 and Russell 2000, there is a negative correlation between the year-over-year gain and the % gain 1-6 months out.

However, for the Nasdaq, SP-500, Dow, and NYSE, going back to 1991, the relationships are statistically insignificant for all time frames. On the Russell 1000 it is slightly positive (except for 1 month where it is insignificant). On the Russell 2000 it is a negative correlation. So, this indicator depends on what time frame you pick. The decision for the investor right now is if the 2003-2006 pattern will hold, or if the historical pattern will hold?

Hello Chris, this is my first reply, your website is the shit, anyways, I’ve only been investing in stocks for 2 months, do you think it is best for me to buy large cap stocks instead of small caps because of the markets strange behavior at this present time and my lack of experience.

Nice post. The idea of not selling until a true sell signal comes along is worthy advice. I typically evaluate each posiiton on its own merits. This approach finds me holding many stocks during pullbacks, as they never flash true distribution. These often possess the bonus feature of bouncing back the fastest of all.