To short means that you borrow stock from your broker to sell to a third party. The idea is to buy back the stock at a lower price, returning the shares to your broker while leaving the remaining cash in your account as a profit. A short seller does not own the stock before they sell it as they borrow it from another investor who already owns it. At a later date, the short seller buys back the stock they shorted and returns the stock to close out the loan. If the stock has fallen in price since they sold short, they can buy the stock back for less than they received for selling it. The difference is your profit. Please note that short selling is a transaction made on margin.

To initiate a short sale, you must place the order with your broker or online brokerage by determining the size and price at which the trade will occur. Your broker or brokerage company will check to see if shares are available in the specific stock selected or if they can borrow the shares. Once they are available or can be borrowed, they will be sold in the open market on the first plus tick or continuation of an up-tick also known as zero-plus tick (the stock must move up for the transaction to complete). To close the short position, the broker will purchase the shares using the original proceeds and return the shares to the third party.

As a short seller, you believe that the price of a particular stock will fall in value over time. For example: by establishing a short position for 100 shares in XYZ at $50, the broker will place $5,000 into your margin account. If the stock falls over the next few weeks and you decide to cover the short at $40, you will initiate a buy for 100 shares in XYZ using the money placed in your account when you sold short. The cost to buy back the shares in this example will be $4,000 or $1,000 less than the original short sale amount. This difference in price will result in $1000 cash that will now become your profit.

On the flip side, if the stock was to jump to $60, you would most likely cover your short or have your stop loss triggered, buying back the shares at this price. The cost would be $6000 or $1000 more than the original short sale, resulting in a 20% loss. The broker would take the additional $1000 from your cash account to cover the loss in the short sale. This is how you can lose money when shorting stocks. The higher the stocks rises, the more money you can lose, theoretically resulting with an infinite loss (excluding stop losses and broker margin calls).

If the stock rises in price or if the value of the stocks you are using as collateral goes down in price, you may be forced to add cash to your margin account or cover the short sale prematurely. Keep in mind that you must pay any dividends issued while you are short a particular stock.

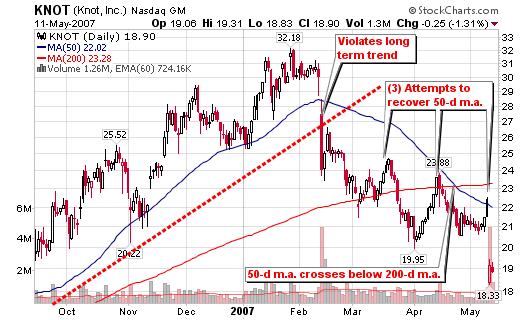

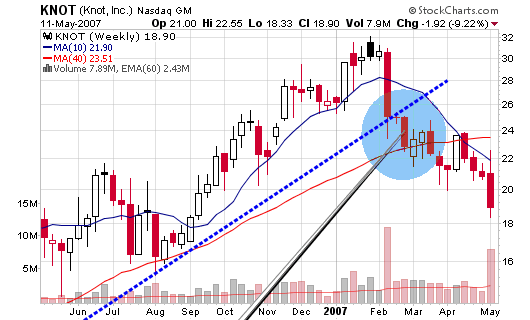

The two basic reasons for selling short would be to profit from a stock that you believe is grossly overvalued (fundamentally or technically) or to hedge your account with protection from a down-swing in prices due to anticipated or unexpected events. I will use the KNOT as an example of the first scenario as it has sliced through all long term trend lines in above average volume. If the stock continually fails to recover these key trend lines, a further decline may be in the immediate future and you may want to profit from this action. In the second case, you may own several stocks and fear a market downturn is on the horizon but don’t want to sell for certain reasons. Instead, the investor can short specific stocks to hedge their account against possible down-turns. Some investors diversify their portfolio with several long positions and a few short positions.

A short should be covered when it rises above the 200-d moving average and certainly covered when it rises above the 50-d moving average (especially if this line is above the 200-d m.a.). If the relative strength line starts to rise, gradually making its way to new high territory, I would advise covering the short position before a big breakout occurs.

Shorting stocks may contribute to a more consistent strategy throughout up-trending and down-trending cycles. As I have said in this blog before, shorting is not for everyone and nothing is wrong with sitting in cash during bear markets, awaiting the next breakout and a fresh batch of leaders.

Many traders believe that the most obvious area to place a short would be near the peak of stock’s trading range but I have found this to be untrue. Stocks making higher highs usually continue to make new highs so stay away from this strategy.

Characteristics of Trend-trading Shorts

Most ideal longer term trend shorts take four to twelve months after the peak price to setup on the weekly chart with the majority of these shorts triggering between six to nine months.

- Look for stocks that had prior up-trends and support levels that can now act as downward resistance or entry areas.

- Once a stock tops and starts to consolidate, you want it to slice through the 50-d moving average and then the 200-d moving average.

- A crossover between the 50-d m.a. and the 200-d m.a. is ideal and is graphically presented on the KNOT chart

- The odds of success increase with each failed attempt for the stock price to recover these major long term moving averages.

- Head and shoulder tops can also serve as ideal setups for potential shorts if they take at least five months to develop.

- A decreasing relative strength line and a negative pattern on the point and figure chart can also confirm that the stock is rolling over and setting up an ideal short.

- Finally, volume should be increasing and the stock should be under distribution as it violates the major moving averages and starts to break former support levels.

Additional criteria for shorting candidates can be decelerating earnings and sales and a relative strength line heading down. Investors can also take the characteristics that we use for locating long positions and reverse the criteria to develop a list of possible short candidates. Even familiar chart patterns can be used to spot shorts; the reverse cup shaped base, the head and shoulders pattern and/or the flat base with a stock breaking heavily to the downside on above average volume. Industry groups that are becoming weak or are showing multiple stocks falling and breaking through key trend lines should be noted on a watch list. If one stocks looks like a short candidate, look for additional sister stocks that may have the same set-up. Remember, stocks usually move in groups whether they go up or down.

Most important: Always cut your losses quick! This rule applies to any strategy in the stock market.

Very helpful site. I pick up the links to use for my sites on http://www.coollikeme.stumbleupon.com and coollikeme.wordpress.com. You do a great job at helping people with stocks.

Thanks for this info. I’ve been trying to learn strategies for shorting stocks but haven’t been doing to well.

Chris,

Looking for an advice – In a bullmarket, how do you buy stocks when most of the leaders are already high off the 50/200 M.A.?

Do i just wait till the market cools down a bit, or try harder to find the stocks got behind of the general market run?

Let me know!

Thanks

Hi Chris, your site is very informative and educational. I also took a look at MSW.

Is the subscription service at MSW still available and updated? I read some comment in one of your posts that it has not been updated recently. Another blog entry of yours indicated a possibility that you will switch to a blog/ad format. I am wondering if I should subscribe now, since you might be terminating the service soon.

Feel free to email me when you have updates on what is happening.

Thank you!

Mark,

As you will see if you search the “stocks” category, I look for stocks gaining support above the 200-day moving average. 90% of my buys have been using this strategy over the past six months. I would not buy leaders breaking out at this time because the market is now up more than 25% versus last year.

Also search for stocks within 15% of new highs that trade near their 50-d m.a. (with support).

Hp,

MSW is under re-design for a new free format layout that should be completed soon enough. Until then, please follow this site and I will let everyone know when MSW re-opens with my detailed equity research.

I’ll be scanning the market for shorts today, the ones I’ve got earmarked are SPY, NVR, LFG, BSC, MTB, OMG, GS, CRS, IWM, HD, TTI, C, FED, NC, and NTAP. I’m going to take a look at your Under Armour play as well.

Short sales are looking even better right now. I noticed the inventory is raising locally. Might be a good thing for investors.

Hi Chris-

I really appreciate your blog- thanks. You mentioned the use of puts instead of shorting stocks. Do you have parameters that you use for put buying that you could share? Do you generally buy itm, otm ?? Front month or farther out? What do you look for in determining what price & when to buy ( once you have decided on the underlying)?

Thanks, Sally

I have no clue how one person can “borrow” a share out of another persons portfolio without them knowing it and then sell it? It makes no sense. What if that same person who they borrowed the shares from decides to sell those shares the same time the short seller is holding on to them. Whats it being backed by? Is it just like our paper bills which aren’t really backed by anything either?

Thats like saying someone “borrowed” my car while I didn’t know it, then sold it for less than whaat it was worth, pocketed the cash, and returned the car back to me the next day. But it really never left my parking lot.

Sounds like BS to me.

Like someone is just getting some free money upfront from nowhere and then can sell some shares he really doesn’t have, and keep that money he got from the sale and subtract it from the amount he got from nowhere. Bam! instant cash…… WTF???

Can someone explain it better or is that whats REALLY going on?