Stock of the Day – Update

Mastercard Inc.

Wednesday’s Closing Price: MA – $126.35

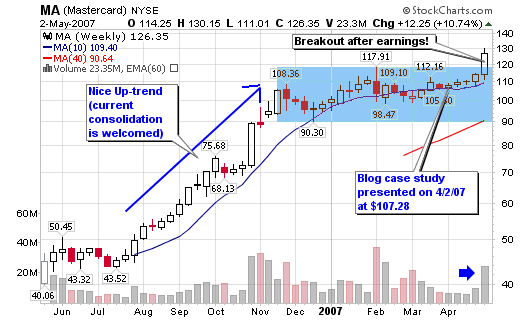

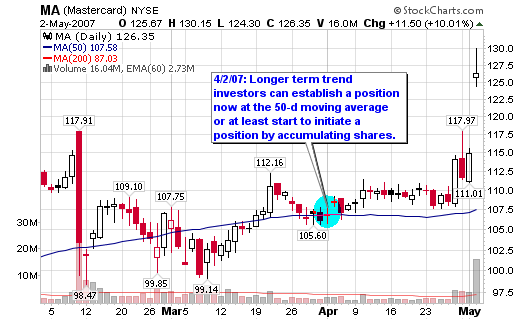

I highlighted Mastercard as a case study on April 2, 2007 in a post titled, Is Mastercard Priceless, while it was trading at $107.28. Closed at $126.35 yesterday!

Here are two quotes from that post one month ago:

- 4/2/07: “Longer term trend investors can establish a position now at the 50-d moving average or at least start to initiate a position by accumulating shares. Look for a confirmation on a move to the up-side above the trading range I have highlighted in blue on the weekly chart.”

- 4/2/07: “Bottom Line: MA is rated a buy in my book and I am grabbing shares today.

*This blog post is not a recommendation to buy this or any other stock. Please do your own due diligence and buy and sell at your own risk!”

Now for the official reason why MA was up over 10% yesterday and has a 17% gain since the case study done on April 2:

First quarter earnings rose 70% boosted by higher gross dollar volume and a 19% jump in the number of transactions processed. The Purchase, N.Y., issuer of credit and debit cards and provider of a transaction authorization network reported first-quarter earnings of $214.9 million, or $1.57 a share, up from $126.7 million, or 94 cents a share, a year earlier. MasterCard said net revenue for the quarter rose 24% to $915.1 million from $738.5 million a year ago. Analysts surveyed by Thomson Financial expected, on average, earnings of $1.16 a share on revenue of $842 million.

Great pick! You’re weekly time frame has inspired me to switch to that time frame to gauge accumulation vs. distribution! thank u!

hey Chris,

thanks for the great coverage on MA, I squeezed out a nice profit on this one!

Aloha!

-Ty

Ty, Nice job. Did you buy shares or options?

Yaser,

I find weekly charts the best to gauge overall trends and acc vs. dis. I use daily charts to pinpoint entry and exit strategies.

I found your initial analysis compelling. Did you trade off your analysis?

I did an options spread. I should have done straight calls but the risk manager in me thinks otherwise sometimes. Pulled out around a 2.7R gain with the options. Great coverage!

-Ty

you have really been hitting them this year…….one that you mentioned awhile back was MR and its been basically going sideways into mid May earnings>>>>>>>any thoughts on MR…. used your remarks to exit calpine at 3.81 thanks, toby

Market Spec,

Yes I did buy shares that day as I said at the bottom of the post.

Toby,

I owned MR for a while but bailed out with a loss after it failed to meet expectations. I don’t plan to own it again for now. I am pissed I didn’t get back into EDU at $38 after my sell in MR. It was my plan but I did otherwise.