Stock of the Day – Updated

New Oriental Education & Technology Group Inc.

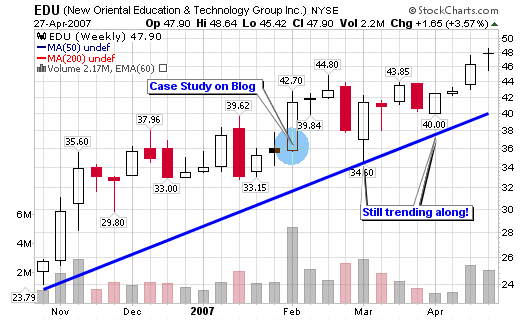

Monday’s Closing Price: EDU – $47.90

Sector: Consumer Discretionary

Industry: Education Services

The stock is still trending from my original analysis areas and has performed better than most of the Chinese stocks I have covered. It is now up about 30% from the February coverage and seems to be trending higher with a steady angled pattern.

Both the 50-d moving average and the trendline I have provided can offer additional areas of accumulation. A new position should be established near the trendline and not the 50-d m.a. (it provides a more favorable risk to reward ratio).

Institutional Numbers (February Numbers):

Shares Bought last Period: 6,313,271

Shares Sold last Period: 22,600

Value of Shares Bought: $227,073,203

Value of Shares Sold: $770,637

Previous Posts on EDU:

- February 6, 2007: Learning about New Oriental Education (EDU)

- February 7, 2007: EDU Breakout on Huge Volume!

- February 21, 2007: Intercontinental Education – The 20% Rule?

- March 23, 2007: Top 10 Stocks to Watch: Trend Buys

why do you not have a “print” button. Your stuff is interesting but I need to print it to comprehend all your points.

Chris,

I originally bought EDU on 2/27 (one of my first of 3 trades ever into the market as a beginner) at $39.98, but violated my mental stop loss of 8% during the correction period and sold on 3/5 for a loss (putting the rules and guidelines that you advise into action no matter what). But I re-entered a new position on 3/9 at $41.14 on increased volume, and recently sold on 4/25 at $47.41. I remembered what you said a while back that if we just take small gains of 15-20%, then we can have a nice gain by year end. Instead of being greedy on my part, I sold for a 15.24% gain Friday. My target was $48.44 for a risk-reward ratio of 2.2, but because I sold at $47.41, that went to 1.9 r-r-ratio. Nevertheless, it is a gain for the books. With me as a beginnner in the market for only just a few months, this was my first successful trade and a step in the right direction of turning my expectancy into higher territory. Thanks for all that you teach and for helping me build rules & guidelines to follow to becoming a profitable stock investor.

Thanks,

Steven Mac.

Chris, Looking at this and following your points, you are suggesting EDU to be a buy at about $40 (if you follow the trend line and not the 50 d.m.a)? What is your feeling on taking a position today somewhere in the high $42 as it bounced off it’s 50 d.m.a. though? Do you feel it will violate the 50 and if so, would you not see this as a sign of weakness?

Thanks for your input!

Nice job Steve – it’s always good to follow a plan successfully! Now start to build upon this.

Albert,

Shares can be added near that trendline above $40. You can also buy at the 50-d m.a. but please note that it did drop below the 50-d in early March which formed this trendline. Either buy is sound as long as the risk-to-reward makes sense. Have a stop loss and you will be okay!