Stock of the Day

New Oriental Education & Technology Group Inc.

Monday’s Closing Price: EDU – $36.93

Sector: Consumer Discretionary

Industry: Education Services

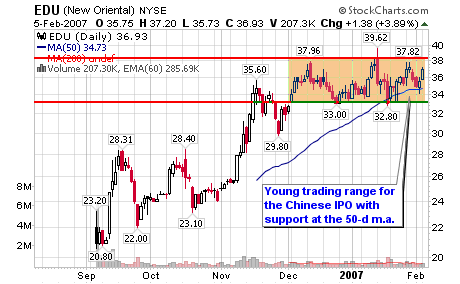

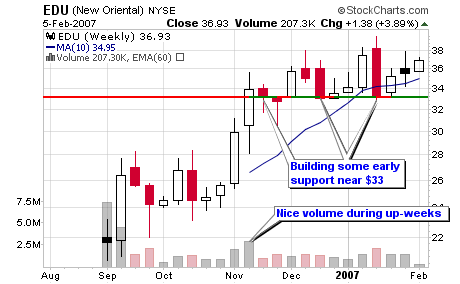

Not a lot of data exists for the young Chinese stock so I wanted to take the time to focus on institutional holdings and the amount of shares that have been accumulated so far (the first reporting period). As you can see below, the majority of new institutional investors loaded up over the past couple of months and I suspect that it all started in November when volume surged and the price accelerated from $26 to $33.

The stock has since consolidated and traded sideway with support near $33 and at the 50-d moving average but is starting to trend higher (slowly). I don’t own shares as I write this report but I am looking to own shares within the next couple of weeks (could be as early as today). I am currently setting up my risk/reward strategy and calculating my stop loss and potential target area. I have limited data to calculate a realistic target but I do have enough to set up my sell stop and total risk.

I like when I see $227 million worth of shares purchased and 93 new institutional holders versus only $770 thousand worth of shares sold. This shows me major support and interest by the so called “smart-money”. The company sounds interesting and looks to have an excellent market (a description is below).

Held by Institutions: 13.10%

Money Market: 45 (42 new positions)

Mutual Fund: 51 (50 new positions)

Other: 1 (1 new position)

Top Holder: Massachusetts Financial Services Co.

1.3 mil Shares for < 0.01% of Portfolio

Total Equity Value of Portfolio: $86.0 billion

Shares Bought last Period: 6,313,271

Shares Sold last Period: 22,600

Value of Shares Bought: $227,073,203

Value of Shares Sold: $770,637

Key Fundamental Numbers (Yahoo Finance):

Market Cap (intraday): 1.36B

Enterprise Value (6-Feb-07): 1.17B

Trailing P/E (ttm, intraday): 58.62

Forward P/E (fye 31-May-08): 40.59

PEG Ratio (5 yr expected): 2.01

Price/Sales (ttm): 11.61

Price/Book (mrq): 6.38

Enterprise Value/Revenue (ttm): 9.96

Enterprise Value/EBITDA (ttm): 34.579

Profit Margin (ttm): 16.31%

Operating Margin (ttm): 17.42%

Total Cash (mrq): 149.93M

Total Cash Per Share (mrq): 4.057

Operating Cash Flow (ttm): 37.41M

Next Year Estimate: 0.75

Next Quarter: 0.06

Last Quarter: 0.03

Earnings:

Yearly (2006): 0.12

Revenue (millions):

Yearly (2006): 96.06

Net Income:

2006: 39.8

Cash Flow:

2006: 81.6

About New Oriental

New Oriental is the largest provider of private educational services in China based on the number of program offerings, total student enrollments and geographic presence. New Oriental offers a wide range of educational programs, services and products consisting primarily of English and other foreign language training, test preparation courses for major admissions and assessment tests in the United States, the PRC and Commonwealth countries, primary and secondary school education, development and distribution of educational content, software and other technology, and online education. New Oriental’s ADSs, each of which represents four common shares, currently trade on the New York Stock Exchange under the symbol ”EDU.”

Net income for the six months ended November 30, 2006 was RMB173.3 million (US$22.1 million), representing a 135.7% increase year-over-year.

For the six months ended November 30, 2006 New Oriental reported net revenues of RMB598.4 million (US$76.4 million), representing a 31.8% increase year-over-year.

EDU had a nice breakout today on very high volume. Good call

How can you find the Shares Bought vs. Shares Sold?

I use a private service that shows institutional numbers – Vickers Equity Research.