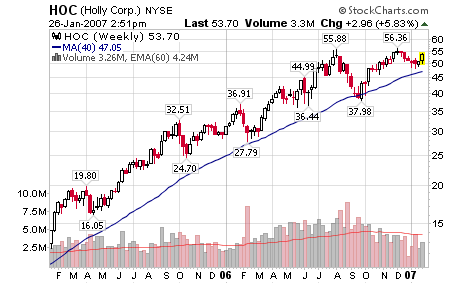

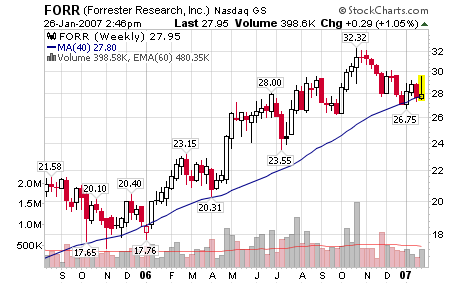

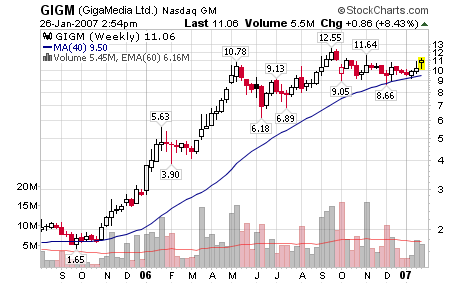

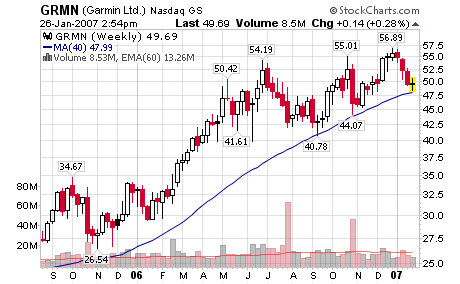

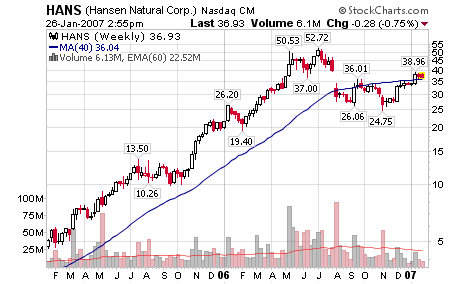

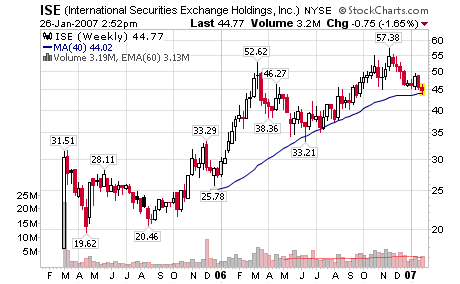

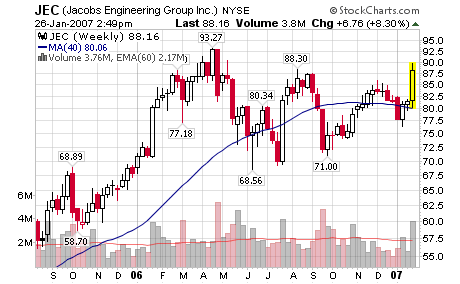

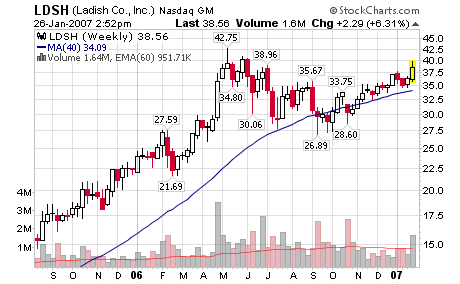

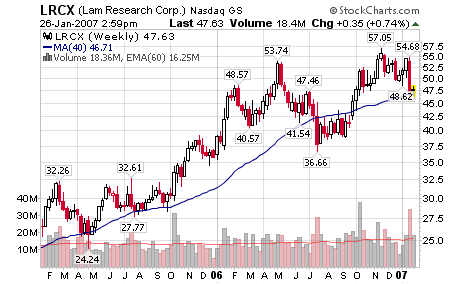

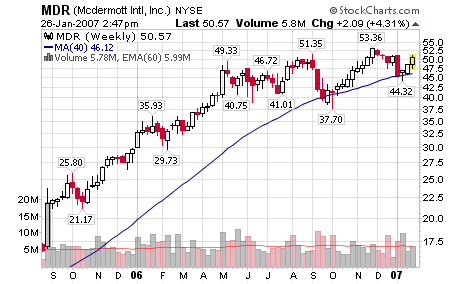

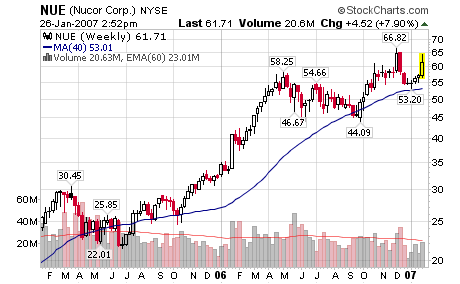

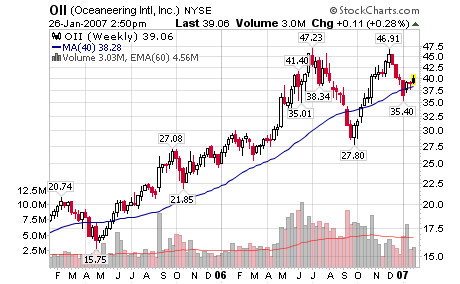

The CANSLIM type stocks listed below are all familiar with their roles of market leadership within the past twelve months but they share another trait:

They are currently trading near support at their respective 200 day moving averages.

Watching these stocks will also give us a clue to the overall market health as many of them have held support above the long term moving average over the past two years. It will be a major red flag to bulls if several of these stocks break support below the 200-d m.a. on above average volume and then fail to recover the line. Ultimately, the price and volume of the NASDAQ and other major indexes will give us the clue to a market breakdown but these stocks may send the red flags earlier putting us into defense mode. If they don’t breakdown, grab shares when you can along the 200-d m.a. and pyramid your profits higher.

Use the peaks and valleys of the former price swings to develop risk/reward ratios to set stops, targets and position size your trades. Trade these types of stocks like a mechanical system and you will profit over the long term without much effort or concern. These guys have institutional support, so trade the trend until it breaks!

Enjoy the Weekend!

200 day, 100 day, 50 day, I even saw someone espousing the merits of the 36 day MA. Is there one MA, or a couple, above all the others that have proven time and again to be reliable?

The most important in my research is the 200-d m.a. for longer term trends and accumulation periods (grabbing additional shares or initiating a position).

I use the 50-d m.a. for shorter term trend trades.

It all depends on your strategy which includes the time frame of your trades. Any moving average is valuable as long as it can reliably help your system produce signals.

Nice Blog 🙂

Very good. I personally believe in 200d ema. All stock investor must learn to trade with the trend. After all, it’s the sit that make money. Keep up the good work.