Stock of the Day

Jones Soda Co.

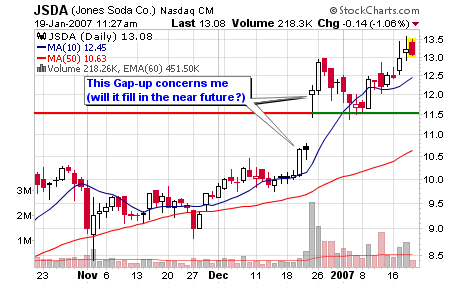

Friday’s Intra-day Price: JSDA – $13.08

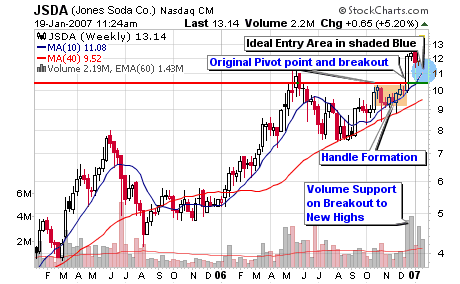

Jones Soda is a lower priced sister stock of Hansen Natural (HANS) which has the potential to make a nice move and a possible up-trend in 2007. The ideal entry area is along the 200-d m.a. with shorter term entry points along the 50-d moving average or above $10.50 on the point and figure chart. I have shaded an area in blue on the weekly chart that interests me for establishing a position as long as the overall market maintains some strength. The stock is currently extended for a buy so I don’t own shares and haven’t taken a position in the MSW Portfolio. Jones debuted on the MSW Index on January 6, 2007 at $11.73 with analysis similar to what I just wrote above.

The overall market has started to flash sell signals so I am not as aggressive in my buying until I know what is going on. Many recent leaders are falling on heavier volume so this raises red flags in my book!

Jones Soda (JSDA) has been featured on two blog posts over the past Six Months:

December 18, 2006

Stock Predictions for 2007 – Oh NO!

“JSDA – 10.03, as mentioned last week, Jones is a low priced sister stock of Hansen Natural (HANS) which has potential of a nice move and possible up-trend in 2007. The Ideal entry area is along the 200-d m.a. with shorter term entry points along the 50-d m.a. and above $10.50 on the point and figure chart”

– The stock is up more than 30% since this blog post on December 18, 2006.

August 18, 2006

Ten Stocks under $10

“JSDA – 7.80, risky as it tests its 200-d m.a. The sister stock of HANS may have downward pressure if Hansen Natural continues to stumble below its 200-d m.a. Stocks move in packs so be wary if HANS breaks down further”

– This would have been the ideal time to buy as it was near the yearly low but I never picked up shares at this juncture because HANS scared me away as it was breaking below the 200-d m.a..

Jones Soda markets and sells its Jones Soda, Jones Naturals and Jones Energy brands through its distribution network in select markets across North America. A leader in the premium soda category, Jones is known for its innovative labeling technique that incorporates always-changing photos sent in from its consumers. Jones Soda products are sold through traditional beverage retailers and everywhere you’d never expect to find a soda.

Next Earnings Date: 3/8/2007

Sector: Consumer Staples

Industry: Beverages – Soft

Stat: Value of $10,000 invested five years ago: $146,941 today

Held by Institutions: 1.78%

Money Market: 57

Mutual Fund: 70

Other: 3

Top Holder: Vardon Capital Management, LLC

2.1 mil Shares for < 0.57% of Portfolio

Total Equity Value of Portfolio: $755.0 million

*The top Institutional Holder (Barclays Global Investors UK Holdings Ltd) for HANS is the number 5 largest institutional holder for JSDA with 500k shares

Key Fundamental Numbers:

Market Cap.: $331 mil (1/10th of HANS)

Outstanding Shares: 25.42mm

Short Ratio: 22.35

Operating Margin: 8.46

Net Income $M: 3.09

ROA (%): 11.20

ROE (%): 13.69

P/E (TTM): 88.86

P/E (Forward): 93.30 (extremely high)

Price to Sales Ratio: 8.65

Earnings per Share (EPS) (TTM): 0.14

Book Value per Share: 0.29

Price to Book Ratio: 8.16

PEG Ratio: 3.11 (much too high for my liking – I target stocks with a PEG below 1.00 and the lower the better).

What is a PEG Ratio?

A stock’s price/earnings ratio divided by its year-over-year earnings growth rate.

Anything below 0.5 is considered excellent

Next Quarter 0.01

Next Year 0.08

Earnings:

Yearly (2006): 0.08E

Yearly (2005): 0.06

Yearly (2004): 0.06

Yearly (2003): 0.02

Yearly (2002): -0.06

Revenue (millions):

Yearly (2005): 33.51

Yearly (2004): 27.45

Yearly (2003): 20.10

Yearly (2002): 18.57

3-Year Sales Rate (growth): 24%

Net Income:

2005: 1.28

2004: 1.33

2003: 0.32

Cash Flow:

2005: 1.50

2004: 1.52

2003: 0.50

The fundamental numbers of JSDA are not in the same league as HANS but the chart does catch my attention. If HANS makes another run, JSDA and FIZ may tag along for the ride. If a risk/reward ratio of 3:1 or better develops, I will grab shares and!

[…] Here are the three latest entries: January 19, 2007 Jones Soda Company JSDA The fundamental numbers of JSDA are not in the same league as HANS but the chart does catch my attention. If HANS makes another run, JSDA and FIZ may tag along for the ride. If a risk/reward ratio of 3:1 or better develops, I will grab shares and! […]