Ticker Sense, the blog run by Birinyi Associates, conducted a year end survey that looks towards the future. It’s titled the “Financial Blogger Outlook” and included 29 of the web’s most prominent financial bloggers (in their opinion of course). They asked a number of questions about the closing prices of the major indexes, the best and worst performing sectors, the top stock picks for 2007 and more.

I was reluctant to participate because predictions don’t mean a damn thing in this business but I did it for fun. I was probably the last blogger to submit my survey and I belive that I actually missed the deadline because I was going to skip the “prediction business”. However, I’ll look back on what I wrote at this time next year and will assure you that my predictions won’t guide my trading one bit.

So, what was my forecast?

Why use the word forecast? Because this word is always associated with the weather and weathermen are typically wrong. Stocks predictors can be lumped into the same stereotype because they are usually wrong too.

I predicted that the major indexes would be slightly lower at the end of 2007.

I predicted that energy and financials would be the top performing sectors.

I predicted that consumer related sectors would perform the worst.

I predicted that growth stocks would outperform value stocks.

I made several selections from the survey that matched one stock’s performance versus another stock’s performance. For example, APPL and MSFT were included in this section. You’ll have to wait until TickerSense publishes these results to see how I selected.

Finally, they asked for five stocks that I felt would outperform their peers in 2007. Once again, I will stress that these stock predictions mean absolutely nothing to me and should mean nothing to you but I’ll tell you what I wrote.

Since I was already compiling a similar watch list on the MSW Weekly Screens, I decided to go with a few young stocks that seem to be trending higher, near new highs with products or services in demand. A complete CANSLIM approach when you think about it!

I have stopped trading for the year due to the holidays, visiting family in NY, family coming to NJ and the New Year bash at my house. Bash might not be the right term.

Even though I have stopped trading, I have not stopped my research so I can step right into the game come January. I am searching for stocks that are trending higher, have increasing earnings and are fairly young to the stock market (IPO’s within the past several years).

Here are the five stocks that I am watching for early 2007 and the exact stocks I selected to outperform in 2007 on the survey. Don’t listen to me, listen to the stocks and act accordingly because predictions are typically wrong!

Iconix Brand Group

ICON – 19.82, the ideal entry for this stock is near $17.50 or the 200-day moving average. Volume has been increasing as the stock has been trending higher over the past 18 months. I do expect a consolidation period before the next advance but that is just my opinion. Let the charts tell you what is happening.

![]()

Nymex Holdings, Inc.

NMX – 129.01, a young sister stock of CME, ISE, ICE and BOT. Based on the success of the others, I have no reason to expect any less out of this recent IPO. The stock is currently ticking higher over the past couple of weeks but there is still a lack of technical data to get a true picture. A stock I will definitely be watching in 2007 based on my success in ISE and ICE.

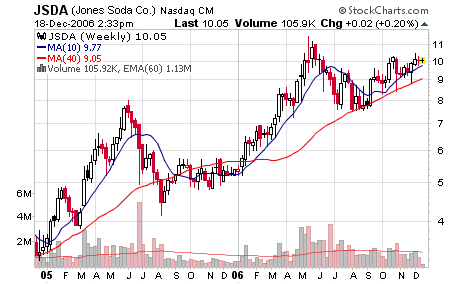

Jones Soda Company

JSDA – 10.03, as mentioned last week, Jones is a low priced sister stock of Hansen Natural (HANS) which has potential of a nice move and possible up-trend in 2007. The Ideal entry area is along the 200-d m.a. with shorter term entry points along the 50-d m.a. and above $10.50 on the point and figure chart

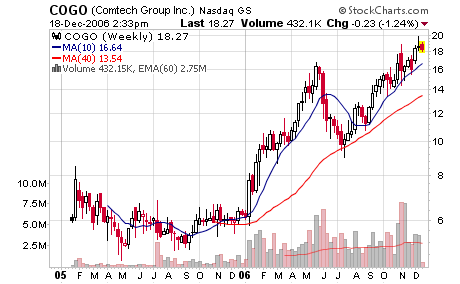

Comtech Group Inc.

COGO – 18.50, Comtech is trending higher but is now extended from the 200-d m.a. with a reversal to end the week. Volume has been increasing while the stock reached and floats near new high territory. The ideal entry area is along the 200-d m.a. with shorter term entry points near the 50-d m.a.

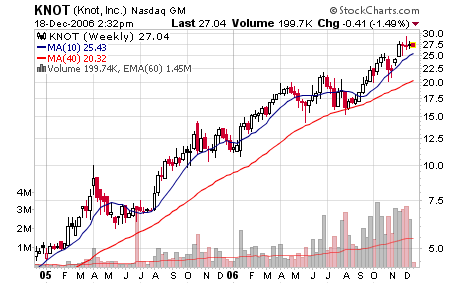

Knot, Inc.

KNOT – 27.45, the stock has made multiple daily and weekly screens (MSW Index) over the past year but I removed it earlier than I should have. I made a mistake and explained that in detail in a blog post this past fall. It’s currently extended from the 200-d m.a. and has been trending higher for two straight years. The next ideal entry will be closer to the 200-d m.a. if the stock shows support.

ICON and KNOT are moving in nice channels.

Good stuff Chris.